Funeral costs have risen 54% over rate of inflation in past 20 years

15th January 2024

2 min read

Funeral costs have increased at almost twice the rate of inflation over the past 20 years, according to the 20th edition of the SunLife Cost of Dying Report the leading and longest-running report into funeral costs.

Average funeral now £4,141

SunLife's data shows that, after two years of lower funeral costs – in part due to the pandemic – prices are on the rise again. In 2023, the average funeral cost[1] was £4,141 – 4.7% more than in 2022.

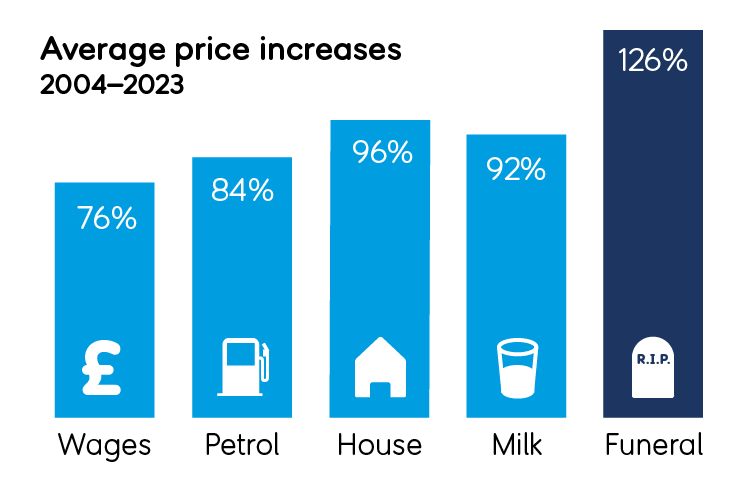

With a 4.7% increase year on year, funeral costs have risen below the high rates of inflation the UK has seen over the past year. However, since the first Cost of Dying Report in 2004, the cost of a basic funeral has increased 126%. That's 54% higher than the rate of inflation over the same period (72%)[2].

- 76% Wages

- 84% Petrol

- 96% House

- 92% Milk

- 126% Funeral

If funeral costs had risen at the same rate as inflation, they would now be over £1,000 lower. Conversely, if house prices had risen at the same rate as funeral costs, the average property in the UK would cost almost £50,000 more[3].

Overall cost of dying at all-time high of £9,658

While the average cost of a basic funeral remains just shy of 2020's all-time high, the total cost of dying[4] – which also includes send-off costs and probate fees – increased by 5% to £9,658, the highest figure ever. A hike in send-off costs to £2,768 and in professional fees to £2,749 means the overall cost of dying is up £458 year on year.

Read the full summary webpage and download SunLife's comprehensive 2024 Cost of Dying PDF report at www.sunlife.co.uk/funeral-costs.

For any press enquiries about this or other SunLife news, please email pressoffice@sunlife.co.uk

Footnotes

[1] The average cost of a funeral includes a burial or cremation, all funeral director fees, a mid-range coffin, one funeral limousine, as well as doctor and celebrant fees.

[2] Bank of England Inflation Calculator(www.bankofengland.co.uk opens in a new tab)

[3] Land Registry UK House Price Index(landregistry.data.gov.uk opens in a new tab)

[4] The total cost of dying includes the average funeral cost, plus professional fees (cost of hiring a professional to administer the estate) and send-off costs (memorial, venue and catering for the wake, flowers, additional limo hire, order sheets, funeral notice, and death notice).

About SunLife

SunLife has been around since 1810, making it one of the oldest financial services companies in the UK. It offers products such as over 50s life insurance and equity release.

SunLife is a part of Phoenix Group(www.thephoenixgroup.com opens in a new tab), one of the UK’s largest long-term savings and retirement business.

SunLife was the first company in the UK to offer life assurance without a medical, and has for many years been the UK’s most popular over 50s life insurance provider (Source: Association of British Insurers). It is also author of one of the longest-running and most highly-regarded reports into funeral costs – the Cost of Dying report.

SunLife also works with leading finance journalists and industry experts to offer everyone over 50 free tools and guides to help with managing their money, planning a funeral and making the most of life after 50.