Daily spending and financial concerns

Part of the Life Well Spent Report 2025

How has our daily spending changed in the last year, and what financial concerns do we have?

Over two thirds of people are paying more for the weekly shop

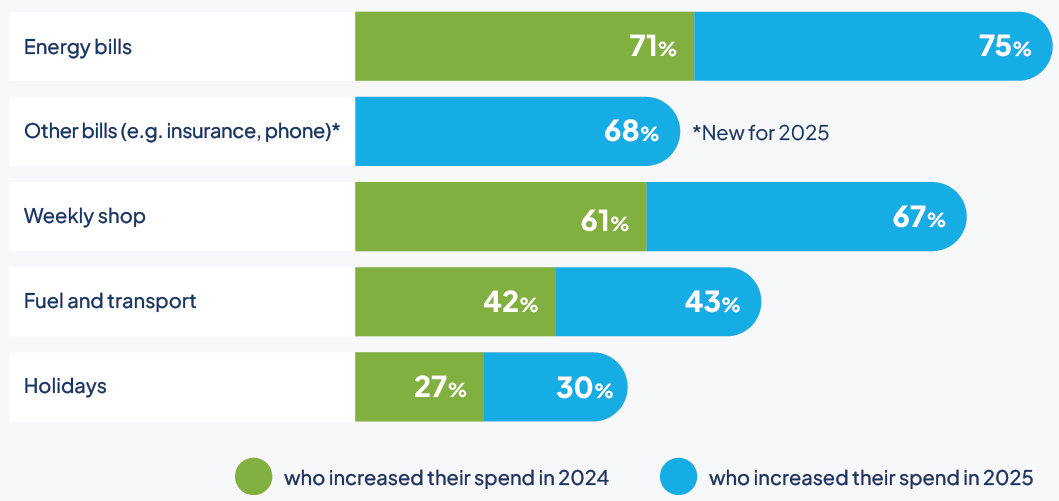

The research for this study was conducted in Spring and Summer 2025, while the high cost of living was still affecting many in the UK. So it's no surprise that 75% of people over 50 say they're spending more on energy bills, and 68% on other bills such as phones and insurance.

What's more, due to the pressures of inflation 67% of people are spending more on their weekly shop in 2025 – 6% more than in 2024, and 16% more than when we released our first report in 2022. While 43% are shelling out more on fuel and transport – a figure that has changed little since our first report.

What people are spending more on

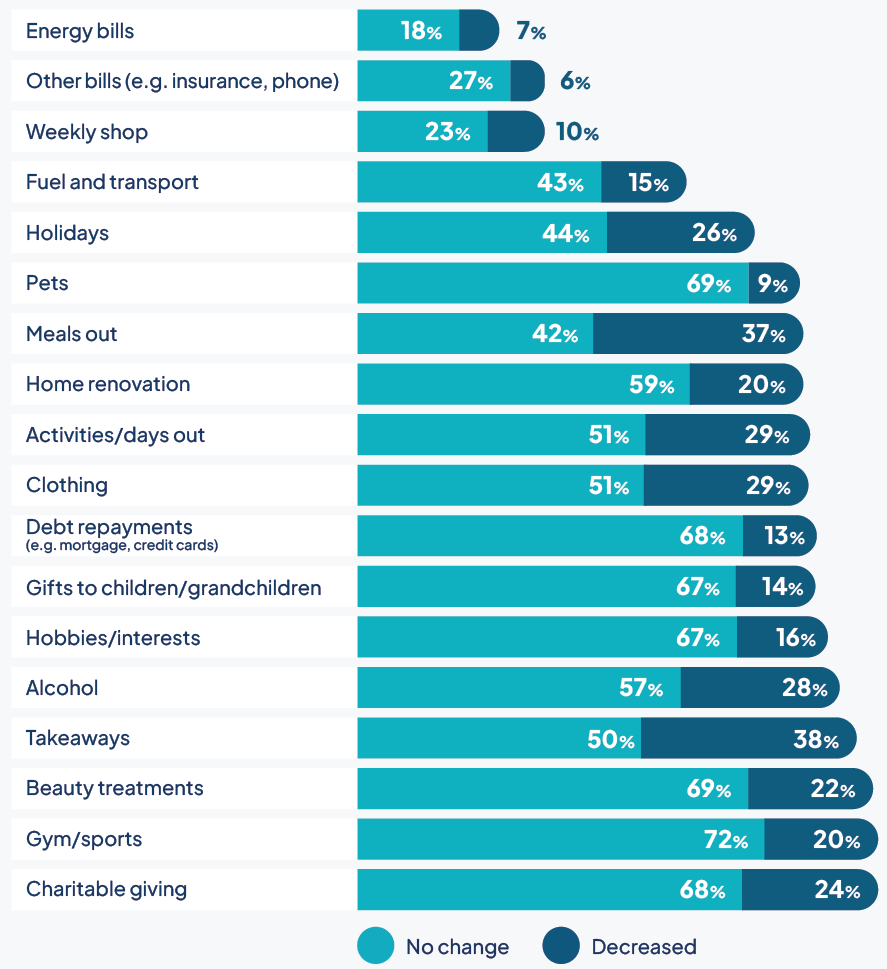

Takeaways and meals out are the first to go

In a year that's seen significant cost increases across food and drink, labour and other consumer goods, takeaways and meals out are the most common areas to cut back in 2025. However, fewer people are tightening the purse strings, with 38% of people choosing to spend less on takeaways – compared to 50% in 2024 and 47% in 2022, when we released our first report. This trend continues for meals out, with 37% spending less on this

Another continuing trend is that people aren't keen on reducing the spend on their furry friends. 69% report no change to their spending on pets (+3% since 2024, and +15% since 2022). And only 9% have decreased it (-6% since 2024, and 17% since 2022).

What people are spending less on

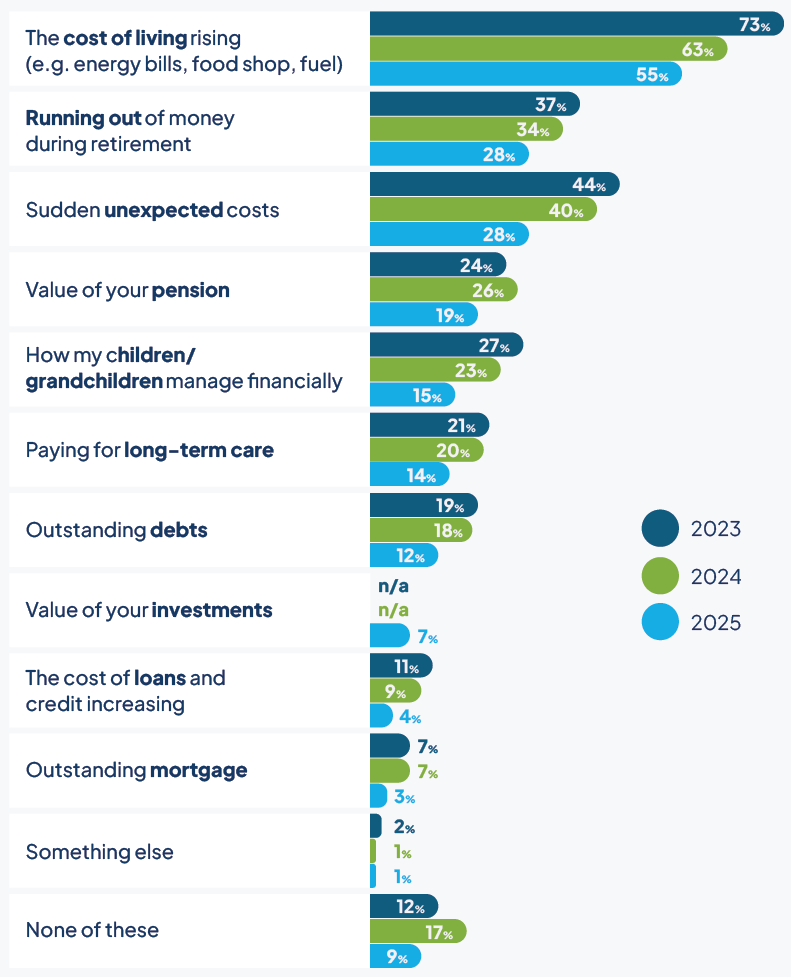

Financial concerns are rising, but fewer are worried about the cost of living

The number of people with no financial worries at all has dropped to 9% - 8% down since 2024, and 2% down since our first report in 2022. This means financial concerns are rising, but also that they are diversifying. So, while fewer people are worrying about the same thing, more people have at least one financial concern on their mind.

Like previous years, the rising cost of living is the most common financial concern. But in 2025 it’s worrying far fewer of us, with 55% of people saying it’s their biggest money worry, compared to 63% last year, and 75% in 2022.

However, when we look at certain demographics, the rising cost of living concerns some more than others. For example, those aged 50 to 59 are more likely to name it as their top concern (43%) compared to people over 70 (33%).

The fear of running out of money during retirement and unexpected costs have both come in at 28%, making them the second biggest financial concerns.

But – like the rising cost of living – the percentage of people saying they’re worried about these things has dropped. Running out of money during retirement has dropped by 6% since 2024 (and by 12% since 2022), and sudden unexpected costs by 12% since 2024.

Biggest financial concerns

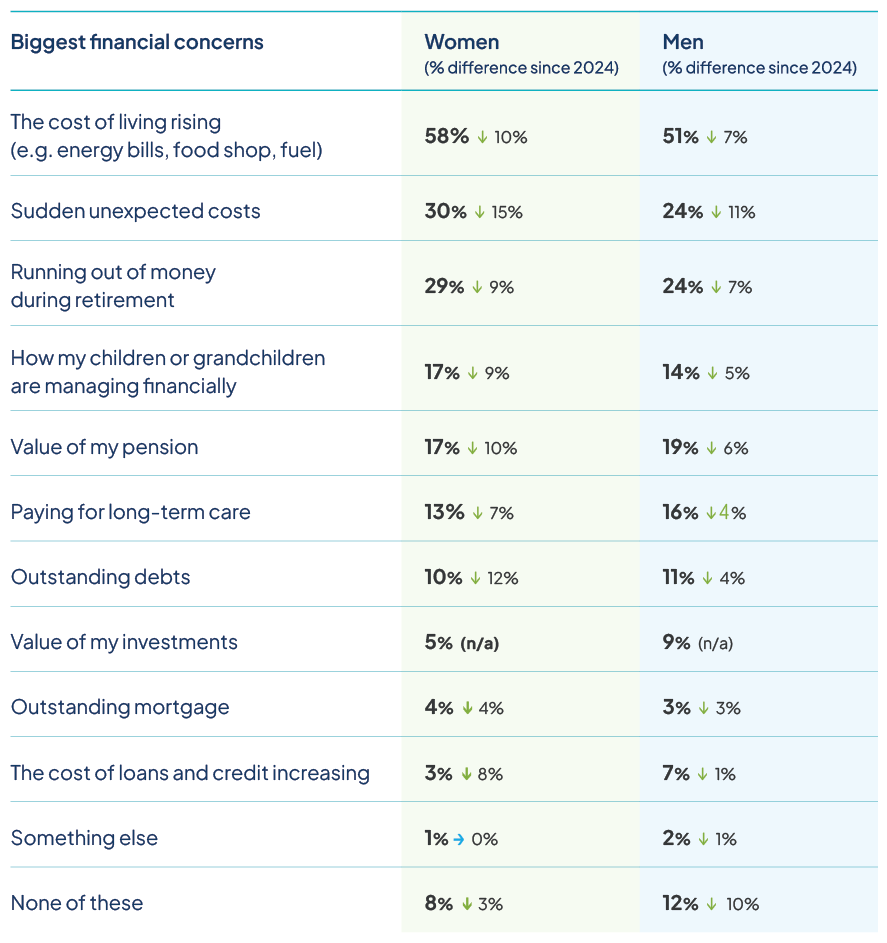

Money worries: men versus women

More women than men name the rising cost of living, sudden unexpected costs, running out of money during retirement, and how children and grandchildren are coping financially as their biggest money worry.

While the overall balance between men’s and women’s financial worries is more even than in 2024, fewer women report being completely free of money concerns at all (8% – down 3%). This is only 1% less than in 2022, when the cost-of-living crisis first hit the UK. 12% of men say they’re completely free of money worries (down 10% since 2024, and down 3% since 2022).

Financial concerns: men vs women

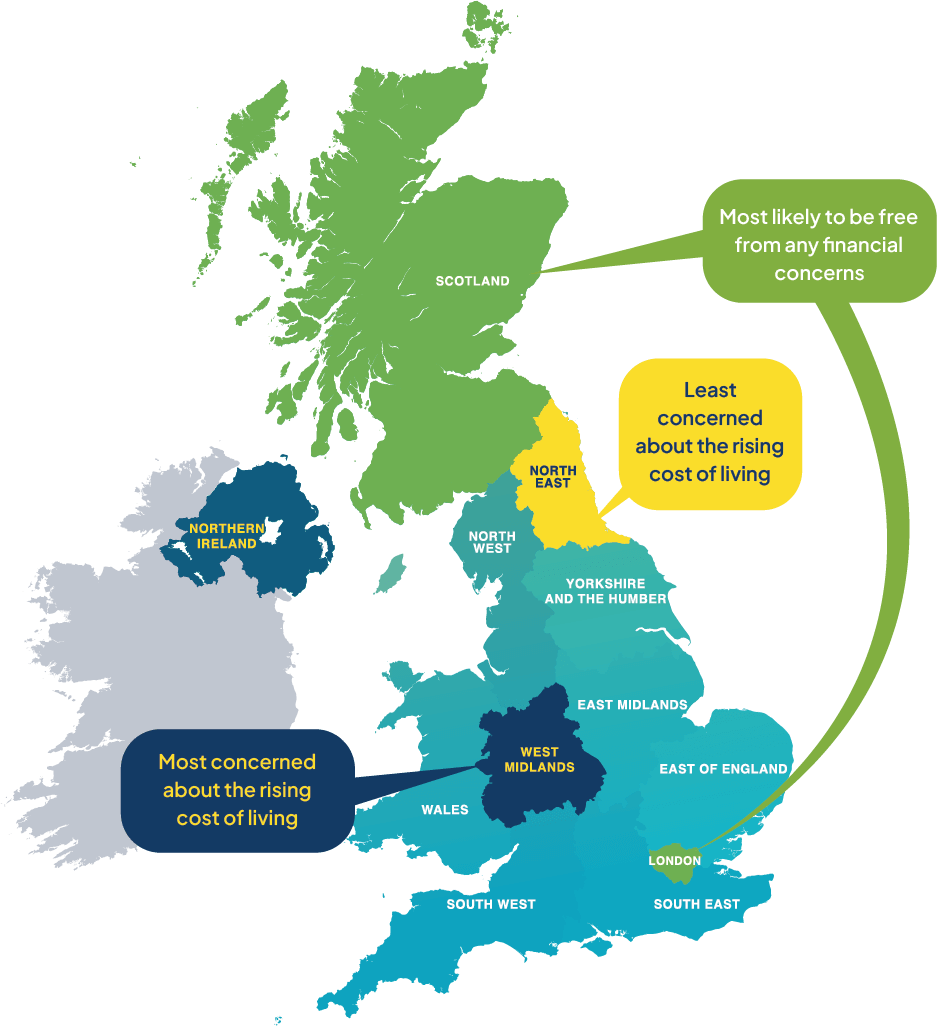

Regional worries

Certain differences in financial concerns can be seen across the UK.

At 56%, both England and Scotland are the most worried about the rising cost of living, compared to 41% in Wales. Wales is also the least worried about sudden unexpected costs, at 13%, compared to Northern Ireland at 32%.

In fact, people in Wales are the most likely to have no money worries at all, at 13%. Whereas people in Northern Ireland are least likely to be completely free of financial concerns, at 4%. However, at 15% Northern Ireland is worried the least about the value of their pension, compared to Scotland at 25%.

The biggest difference appears when we look at paying for long-term care. 42% of people in Northern Ireland name this as one of their top worries, compared to just 5% of people in Scotland. (This is no doubt due to the fact that Scotland has a more comprehensive care provision than the rest of the UK.)

This article forms part of our Life Well Spent report, which looks at the relationship between happiness and big purchases in later life.