Cash gifts later in life

Part of the Life Well Spent Report 2024

Can giving loved ones big financial gifts in later life make us happier?

A quarter of over 50s have given a significant cash gift

1 in 4 (25%) people over 50 have given substantial cash gifts to family members in the last five years (+2% since 2023), rising to 28% for the happiest over 50s, and 36% for the over 70s (+2%).

The average amount gifted is £20,021 – £4,043 more than in 2023. The most common reasons for cash gifts are:

- As a special birthday/Christmas gift (27%)

- To help them with the rising cost of living (23%)

- For a deposit on a house (19%)

- To give an early inheritance (17%)

- To put towards a vehicle (17%)

Over 8 in 10 (83%) of gifters have given significant cash gifts to their children, 22% to their grandchildren (rising to 34% of over 70-year-olds), and 17% to someone else.

When we look at the gifts that were given to their children, 91% were for house deposits, 90% were as an early inheritance to see them enjoy the money, and 86% were for fertility treatment.

Of the gifts that went to grandchildren, 40% were for a special birthday/Christmas gift, 38% were for college/tuition funds, 27% were to help following the birth of a baby, and 27% were for holidays.

The biggest cash gifts are for house deposits

Once again, the biggest cash gifts given to loved ones were for house deposits. The average amount gifted for this reason by all people over 50 is £29,033 (£583 less than last year) – rising to £34,821 for 60 to 69-year-olds.

4.8% of all over 50s have given a cash gift towards a house deposit. This is up slightly from 4.7% in 2023, but down from 6.2% in 2022.

Average amount gifted by the over 50s

| Reasons for cash gifts | Average £ gifted | % of gifters giving for this reason |

|---|---|---|

| Deposit on home purchase | £29,033 | 19% |

| Early inheritance for tax purposes* | £27,137 | 5% |

| Early inheritance (NET) | £26,599 | 17% |

| Early inheritance to enjoy the money | £21,524 | 14% |

| To put towards home renovations | £8,433 | 7% |

| Tuition/college funds | £6,775 | 7% |

| Help start a business* | £6,516 | 3% |

| Put towards a wedding | £4,291 | 13% |

| Put towards a vehicle | £4,050 | 17% |

| Support after lost job/reduced income | £2,397 | 11% |

| Help repay debt | £2,269 | 14% |

| Following birth of a baby | £2,050 | 9% |

| Fertility treatment* | £2,000 | 1% |

| Medical/care expenses* | £1,618 | 4% |

| Special birthday/Christmas gift | £1,590 | 27% |

| Put towards a holiday | £1,541 | 14% |

| Help with rising cost of living | £1,416 | 23% |

*Low base size

The next largest gifts are for early inheritance. On average, those who gifted early inheritance for tax purposes gave £27,137, and those who gifted it to see their loved ones enjoy the money gave £21,524. So the overall average amount gifted for early inheritance is £26,599 in 2024. 23% (+1%) of those giving cash gifts are doing so to help loved ones with the rising cost of living, with an average gift amount of £1,461 – down £149 since 2023.

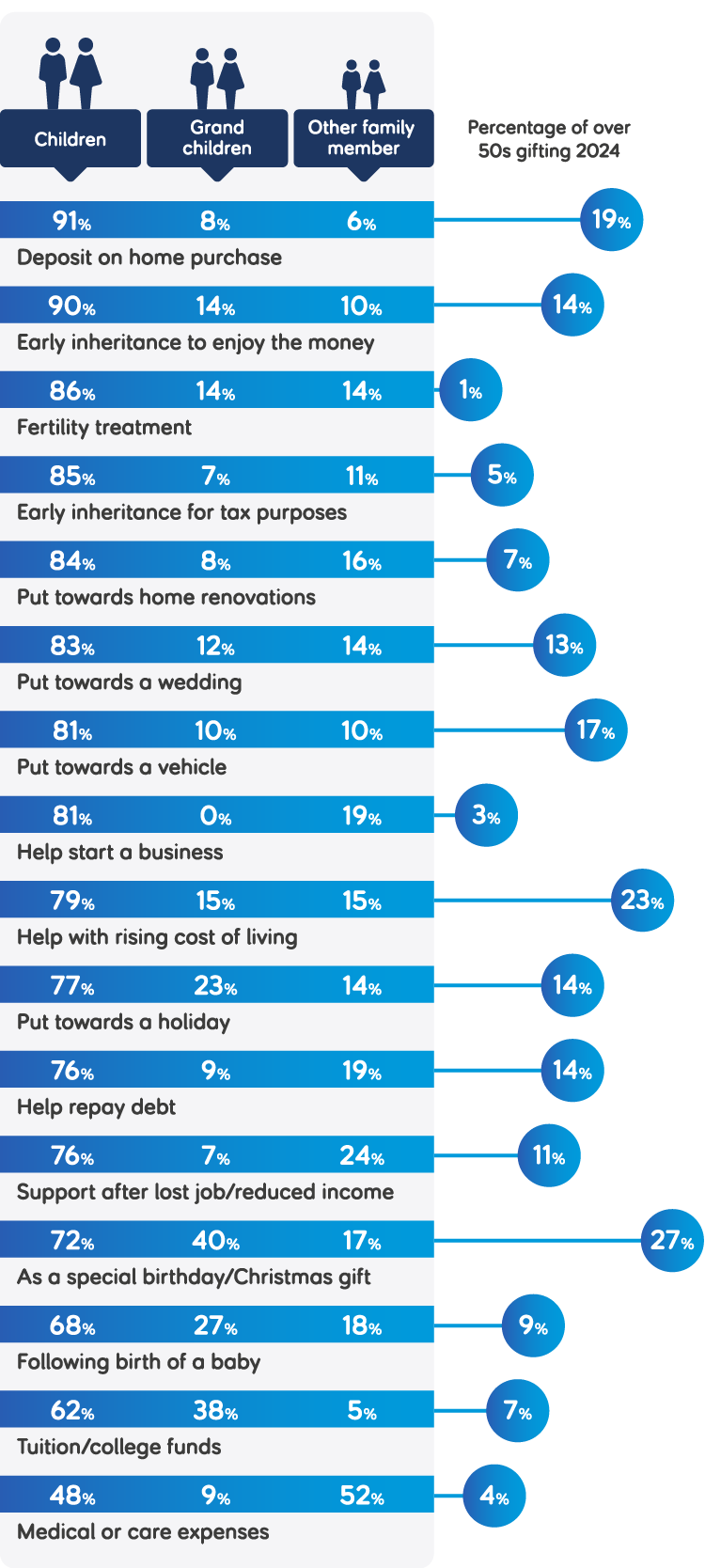

Who did you gift the money to?

The data is as follows:

- Deposit on home purchase. Children 91%. Grandchildren 8%. Other family member 6%. Percentage of over 50s gifting 2024 19%.

- Early inheritance to enjoy the money. Children 90%. Grandchildren 14%. Other family member 10%. Percentage of over 50s gifting 2024 14%.

- Fertility treatment. Children 86%. Grandchildren 14%. Other family member 14%. Percentage of over 50s gifting 2024 1%.

- Early inheritance for tax purposes. Children 85%. Grandchildren 7%. Other family member 11%. Percentage of over 50s gifting 2024 5%.

- Put towards home renovations. Children 84%. Grandchildren 8%. Other family member 16%. Percentage of over 50s gifting 2024 7%.

- Put towards a wedding. Children 83%. Grandchildren 12%. Other family member 14%. Percentage of over 50s gifting 2024 13%.

- Put towards a vehicle. Children 81%. Grandchildren 10%. Other family member 10%. Percentage of over 50s gifting 2024 17%.

- Help start a business. Children 81%. Grandchildren 0%. Other family member 19%. Percentage of over 50s gifting 2024 3%.

- Help with the rising cost of living. Children 79%. Grandchildren 15%. Other family member 15%. Percentage of over 50s gifting 2024 23%.

- Put towards a holiday. Children 77%. Grandchildren 23%. Other family member 14%. Percentage of over 50s gifting 2024 14%.

- Help repay debt. Children 76%. Grandchildren 9%. Other family member 19%. Percentage of over 50s gifting 2024 14%.

- Support after lost job/reduced income. Children 76%. Grandchildren 7%. Other family member 24%. Percentage of over 50s gifting 2024 11%.

- As a special birthday/Christmas gift. Children 72%. Grandchildren 40%. Other family member 17%. Percentage of over 50s gifting 2024 27%.

- Following birth of a baby. Children 68%. Grandchildren 27%. Other family member 18%. Percentage of over 50s gifting 2024 9%.

- Tuition/college funds. Children 62%. Grandchildren 38%. Other family member 5%. Percentage of over 50s gifting 2024 7%.

- Medical or care expenses. Children 48%. Grandchildren 9%. Other family member 52%. Percentage of over 50s gifting 2024 4%.

Giving cash gifts to family makes us happier

Almost 3 in 4 (78% – down 3% since 2023) who gave cash gifts to loved ones said doing so made them happier.

Almost 9 in 10 (87% – up 3% since 2023) say gifting early inheritance to see their loved ones enjoy the money improved their happiness. And the same percentage (+5%) say gifting a special birthday or Christmas gift did the same.

In 2023, the happiest group were those who gifted money to help with medical care. This has dropped to 10th place in 2024, although 3 in 4 (74% – down 8%) still say this made them happier.

Gifting money to help a loved one start a business is the most likely to have no impact on/reduce happiness. But half still feel happy to have helped in this way.

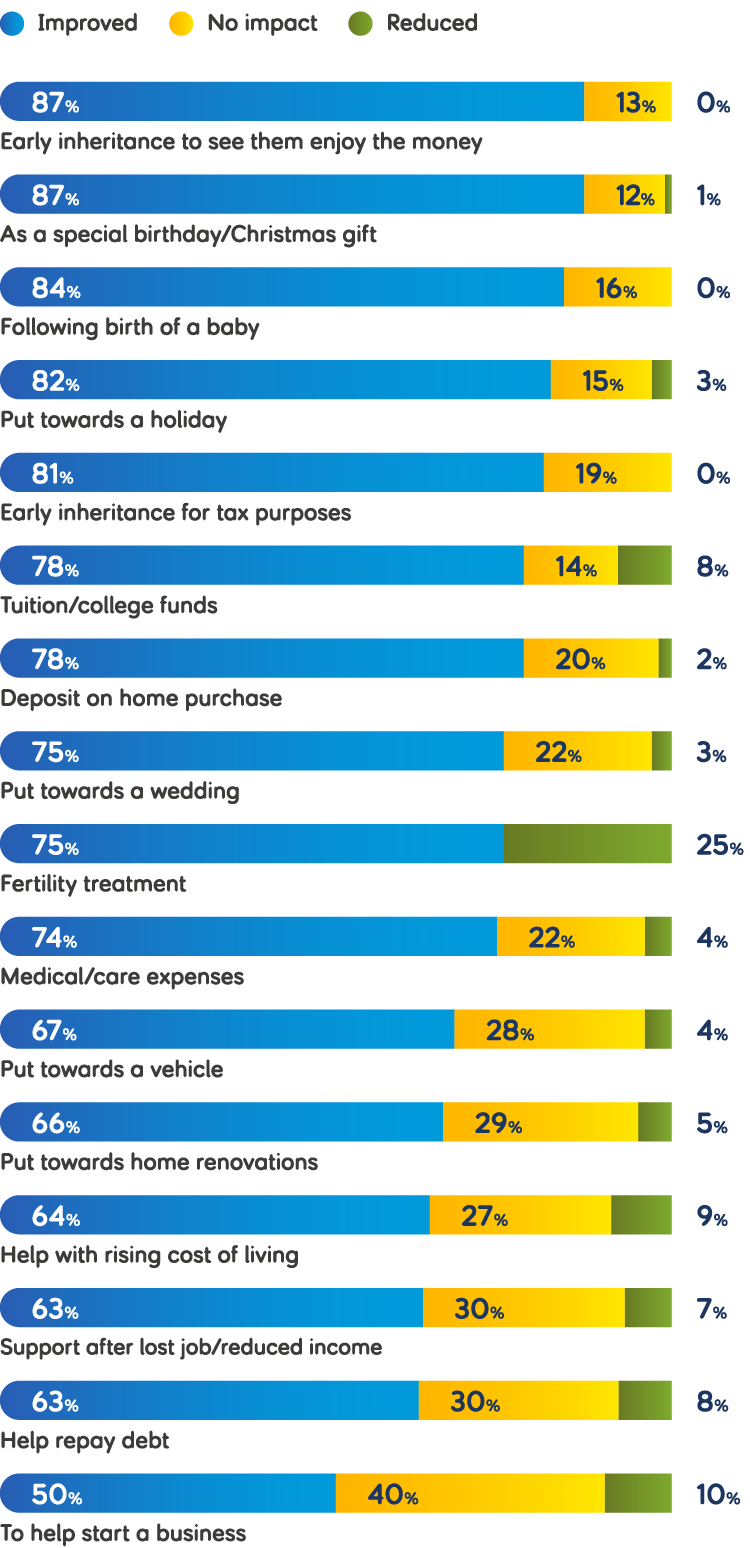

How did spending on cash gifts improve happiness?

The data is as follows:

- Early inheritance to see them enjoy the money. 87% Improved. 13% No impact. 0% Reduced.

- As a special birthday/Christmas gift. 87% Improved. 12% No impact. 1% Reduced.

- Following birth of a baby. 84% Improved. 16% No impact. 0% Reduced.

- Put towards a holiday. 82% Improved. 15% No impact. 3% Reduced.

- Early inheritance for tax purposes. 81% Improved. 19% No impact. 0% Reduced.

- Tuition/college funds. 78% Improved. 14% No impact. 8% Reduced.

- Deposit on home purchase. 78% Improved. 20% No impact. 2% Reduced.

- Put towards a wedding. 75% Improved. 22% No impact. 3% Reduced.

- Fertility treatment. 75% Improved. 25% No impact.

- Medical/care expenses. 74% Improved. 22% No impact. 4% Reduced.

- Put towards a vehicle. 67% Improved. 28% No impact. 4% Reduced.

- Put towards home renovations. 66% Improved. 29% No impact. 5% Reduced.

- Help with rising cost of living. 64% Improved. 27% No impact. 9% Reduced.

- Support after lost job/reduced income. 63% Improved. 30% No impact. 7% Reduced.

- Help repay debt. 63% Improved. 30% No impact. 7% Reduced.

- To help start a business. 50% Improved. 40% No impact. 10% Reduced.

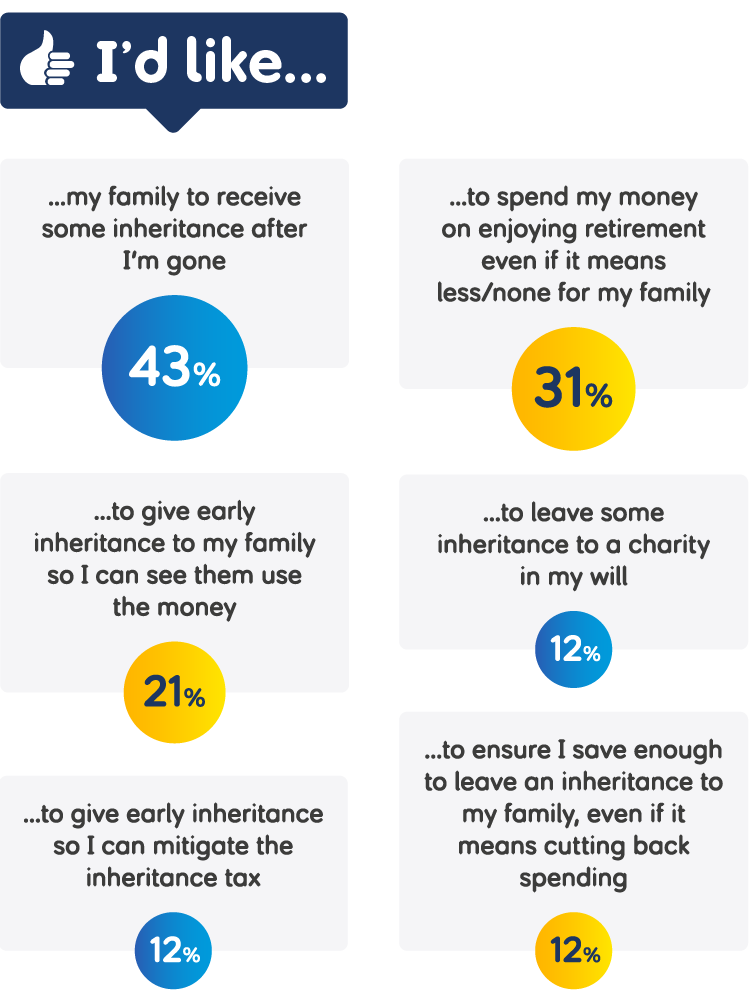

Most over 50s would like to leave an inheritance

The number of over 50s who’d like their family to receive some inheritance when they’re gone has dropped from 49% in 2023, to 43% in 2024. 3 in 10 (31% – up 1% since 2023) would rather spend their money on enjoying retirement, even if it means there’s nothing left to leave as inheritance.

However, 12% (+1%) would consider cutting back on spending in retirement to ensure they can leave an inheritance. And 21% want to give an early inheritance, so they can see their loved ones enjoy the cash – the same number as last year.

12% (+1%) plan to give early inheritance to mitigate inheritance tax. And 12% want to leave a legacy to a charity in their will (despite 31% having reduced their charitable giving in the last year).

Attitudes towards inheritance

The data is as follows:

I'd like...

- ...my family to receive some inheritance after I'm gone. 43%.

- ...to spend my money on enjoying retirement even if it means less/none for my family. 31%.

- ...to give early inheritance to my family so I can see them use the money. 21%.

- ...to leave some inheritance to a charity in my will. 12%.

- ...to give early inheritance so I can mitigate the inheritance tax. 12%.

- ...to ensure I save enough to leave an inheritance to my family, even if it means cutting back spending. 12%.

This article forms part of our Life Well Spent report, which looks at the relationship between happiness and big purchases in later life. You can read the other sections of the report below or download the full report (PDF).