Debt and happiness in later life

Part of the Life Well Spent Report 2024

It’s no surprise that debt can affect our happiness. But what debts are over 50s worried about the most?

How many over 50s have debts?

Around half (48%, down 1% since 2023) of people over 50 have outstanding debts – mostly credit cards, mortgages and personal loans.

34% of retirees have outstanding debts, compared to 56% of non-retirees. And perhaps unsurprisingly, the happiest over 50s are 9% less likely to be in debt than the overall average.

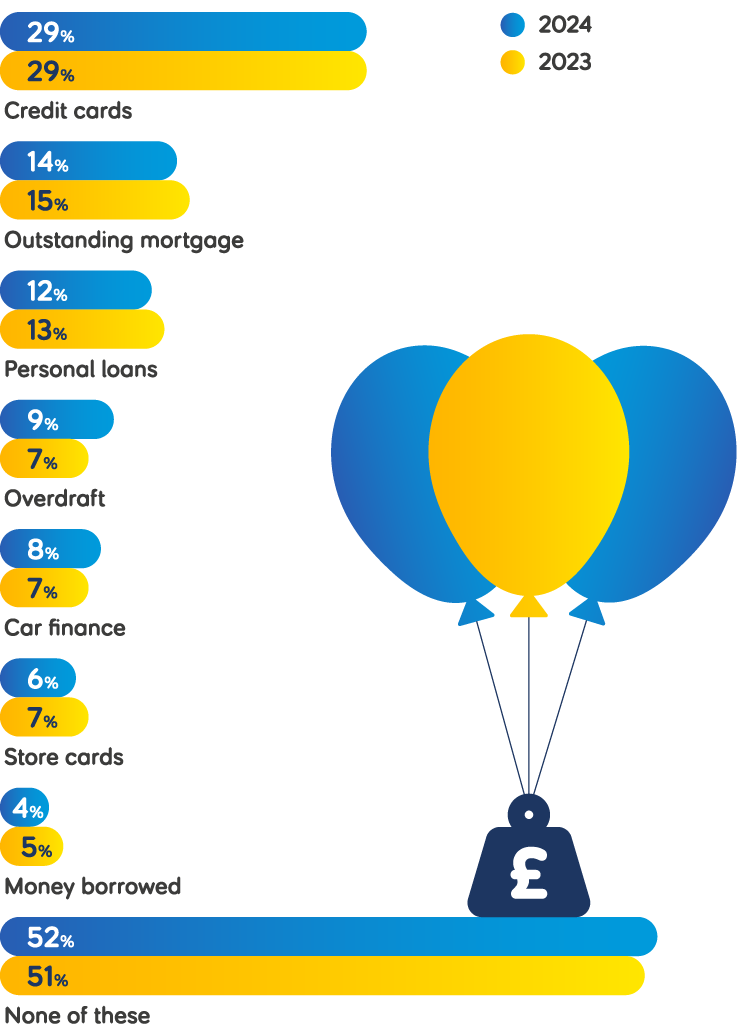

What debts do the over 50s have?

The data is as follows:

- Credit cards. 29% 2024 and 2023.

- Outstanding mortgage. 14% 2024. 15% 2023.

- Personal loans. 12% 2024. 13% 2023.

- Overdraft. 9% 2024. 7% 2023.

- Car finance. 8% 2024. 7% 2023.

- Store cards. 6% 2024. 7% 2023.

- Money borrowed. 4% 2024. 5% 2023.

- None of these. 52% 2024. 51% 2023.

How much debt do the over 50s have?

Over 50s yet to retire have higher outstanding debts than those already retired, across all categories.

Of those who are still paying off their mortgage, they still have £ 67,478 left to pay on average – £2,188 more than in 2023.

5% of retirees still have outstanding mortgages (versus 20% of non-retired). They have an average outstanding amount of £ 63,644, compared to those not yet retired, who have an average of £68,096 outstanding.

29% of over 50s have outstanding credit card debt, the same proportion as in 2023. But the amount of credit card debt has risen across all over 50s, with an average of £3,887 owed – £1,400 more than last year.

Average debt still left to pay

| Type of debt | Amount left to pay |

|---|---|

| Outstanding mortgage | £67,478 |

| Car finance | £9,982 |

| Personal loans | £6,393 |

| Money borrowed | £4,178 |

| Credit cards | £3,887 |

| Overdraft | £1,377 |

| Store cards | £1,003 |

How much debt are over 50s repaying every month?

Those with outstanding debt are spending a total of £724 per month on repayments on average. This represents 32% of total annual personal income (£26,876) or 25% of total annual household income (£35,165) being spent on debt repayment, and that’s before tax or other deductions are made.

At £887 per month, paying off the mortgage is the biggest repayment on average, followed by car finance (£399 per month) and credit cards (£389 per month).

Retirees are repaying an average of £602 per month across their debts, 23% of their average annual household income of £31,064.

Monthly debts left to pay

The data is as follows:

- Outstanding mortgage £887.

- Car finance £399.

- Credit cards £389.

- Personal loans £312.

- Money borrowed £143.

- Overdraft £132.

- Store cards £125.

What debts have the over 50s paid off?

Almost 4 in 10 (39%) of over 50s have paid off some mid to long-term debts in the last five years – that’s up 2% since 2023. But 17% (-1%) haven’t yet paid off any of their debts in full.

21% (+2%) of over 50s have paid off their mortgage in the past five years, rising to an average of 24% for retirees, and 26% for the happiest people.

On average, the over 50s who have paid off their mortgage in the last five years are 63, meaning they paid it off between ages 58 and 63. However, those who are worried about their outstanding mortgage are of a similar average age (58) – and yet they consider paying off their mortgage to be a major concern. This suggests that interest rate hikes in the last couple of years may be impacting their future and outlook on life.

What debts have been paid off in the last five years?

The data is as follows:

- Paid off mortgage. 21%

- Paid off one or more personal loans. 10%

- Paid off another kind of debt. 16%

- Have not yet paid any debts in full. 17%

Paying off debt significantly improves happiness

Of those who haven’t yet paid off their debts, just 57% think it would make them happier to do so, just 3% more than last year. 40% think it would have no impact on their happiness – 3% less than last year – and 4% think paying everything off would reduce their happiness.

But in reality, most people over 50 who’ve paid off their debts do feel happier as a result (83% – 2% down since 2023), including 51% (-4%) who say they feel significantly happier.

How would/did paying off your debts affect your happiness?

The data is as follows:

Those who've yet to pay off their debts

- Significantly improved happiness 39%.

- Slightly improved happiness 17%.

- No impact on happiness 40%.

- Slightly reduced happiness 1%.

- Significantly reduced happiness 3%.

Those who've paid off their debts

- Significantly improved happiness 51%.

- Slightly improved happiness 32%.

- No impact on happiness 16%.

- Slightly reduced happiness 1%.

This article forms part of our Life Well Spent report, which looks at the relationship between happiness and big purchases in later life. You can read the other sections of the report below or download the full report (PDF).