Daily spending in later life

Part of the Life Well Spent Report 2024

How has daily spending for the over 50s changed in the last year, and what financial concerns do they have?

Half of over 50s are cutting back on takeaways, eating out and activities

The research for this study was conducted in Spring and Summer 2024, while the cost-of-living crisis was still affecting many in the UK.

When asked how their spending has changed in the past year, 71% of over 50s say they’re spending more on energy bills.

61% are spending more on the weekly shop (up 2% since 2023, and up 10% since 2022). While 42% are shelling out more on fuel and transport (up 1% since 2023 – but down 2% since 2022).

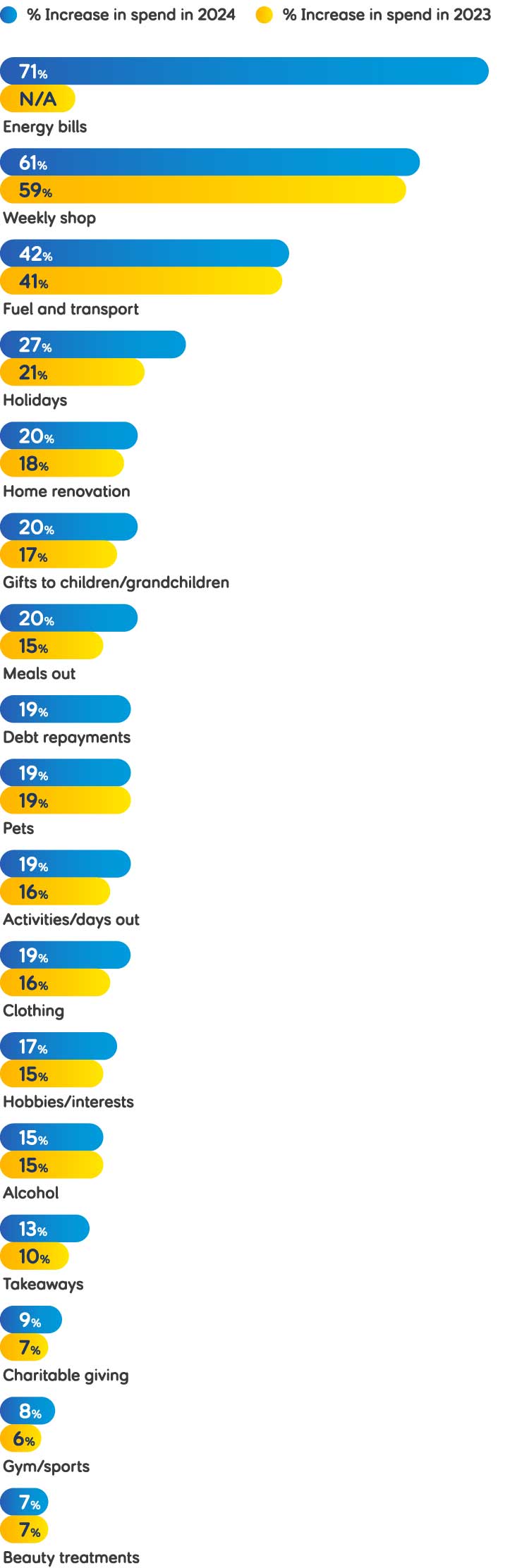

What are we spending more on?

The data is as follows:

- Energy bills. 71% 2024. not applicable 2023.

- Weekly shop. 61% 2024. 59% 2023.

- Fuel and transport. 42% 2024. 41% 2023.

- Holidays. 27% 2024. 21% 2023.

- Home renovation. 20% 2024. 18% 2023.

- Gifts to children/grandchildren. 20% 2024. 17% 2023.

- Meals out. 20% 2024. 15% 2023.

- Debt repayments. 19% 2024.

- Pets. 19% 2024 and 2023.

- Activities/days out. 19% 2024. 16% 2023.

- Clothing. 19% 2024. 16% 2023.

- Hobbies/interests. 17% 2024. 15% 2023.

- Alcohol. 15% 2024 and 2023.

- Takeaways. 13% 2024. 10% 2023.

- Charitable giving. 9% 2024. 7% 2023.

- Gym/sports. 8% 2024. 6% 2023.

- Beauty treatments. 7% 2024 and 2023.

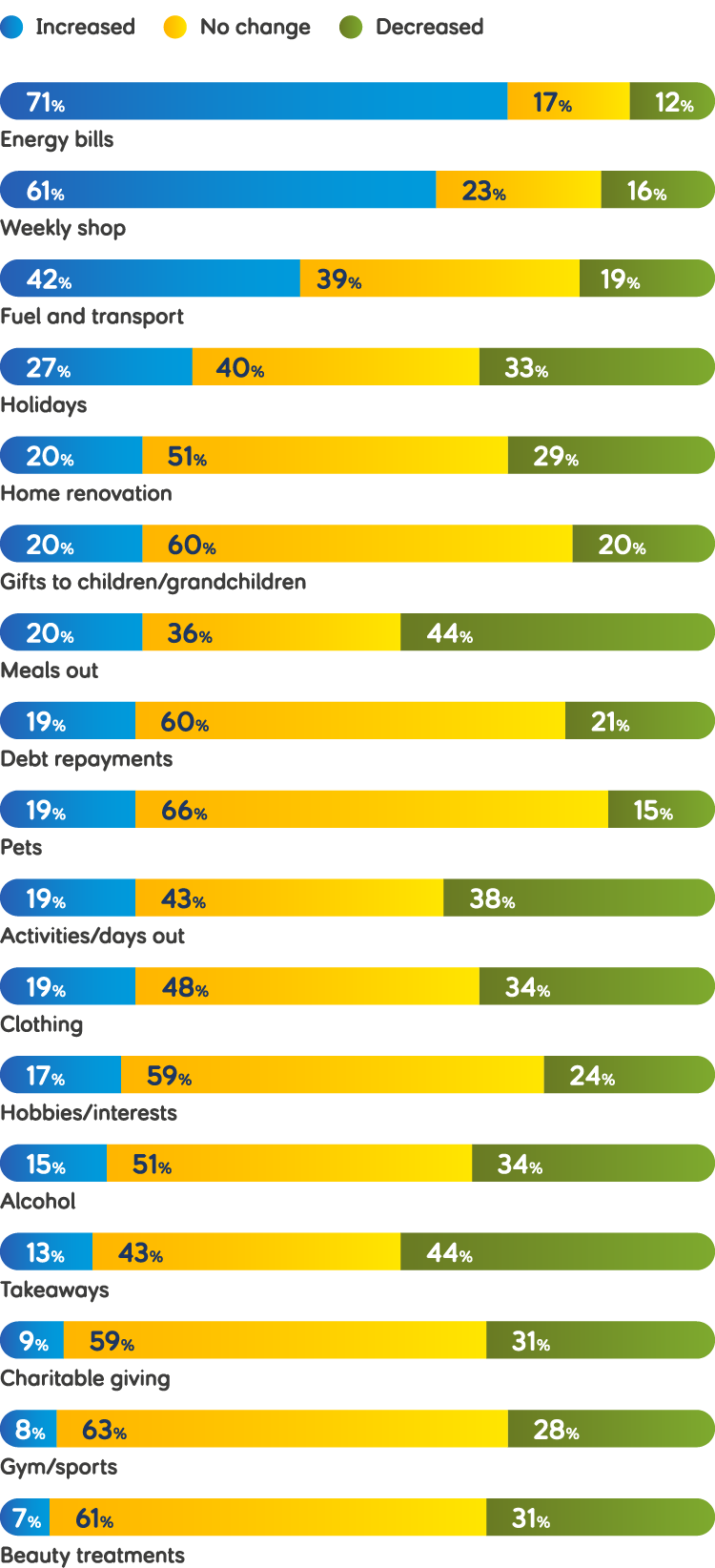

44% of over 50s say they’ve cut back on takeaways – that’s 9% less than in 2023, and 3% less than in 2022. And exactly the same percentage say they’ve cut back on meals out – 8% less than in 2023, and 3% less than in 2022. While 38% have cut back on activities and days out – 9% less than in 2023, and 6% less than in 2022.

Like 2023 and 2022, the area where fewest are reducing their spending is on their pets. 66% of respondents report no change to their spending on pets (+3% since 2023 and +12% since 2022). And only 15% have decreased it (-2%).

Spending changes in the last year

The data is as follows:

- Energy bills. 71% Increased. 17% No change. 12% Decreased.

- Weekly shop. 61% Increased. 23% No change. 16% Decreased.

- Fuel and transport. 42% Increased. 39% No change. 19% Decreased.

- Holidays. 27% Increased. 40% No change. 33% Decreased.

- Home renovation. 20% Increased. 51% No change. 29% Decreased.

- Gifts to children/grandchildren. 20% Increased. 60% No change. 20% Decreased.

- Meals out. 20% Increased. 36% No change. 44% Decreased.

- Debt repayments. 19% Increased. 60% No change. 21% Decreased.

- Pets. 19% Increased. 66% No change. 15% Decreased.

- Activities/days out. 19% Increased. 43% No change. 38% Decreased.

- Clothing. 19% Increased. 48% No change. 34% Decreased.

- Hobbies/interests. 17% Increased. 59% No change. 24% Decreased.

- Alcohol. 15% Increased. 51% No change. 34% Decreased.

- Takeaways. 13% Increased. 43% No change. 44% Decreased.

- Charitable giving. 9% Increased. 59% No change. 31% Decreased.

- Gym/sports. 8% Increased. 63% No change. 28% Decreased.

- Beauty treatments. 7% Increased. 61% No change. 31% Decreased.

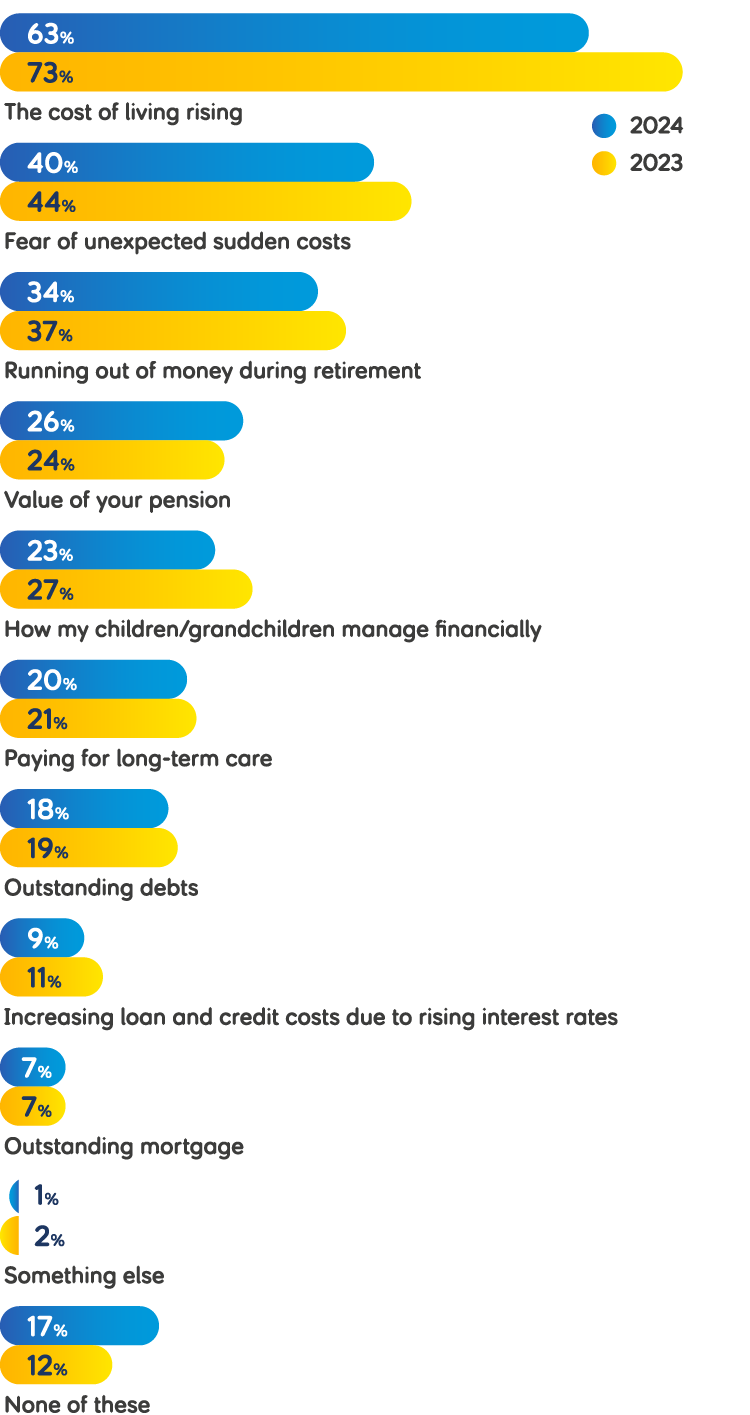

What are the biggest money worries for over 50s?

Just like last year, the rising cost of living is the most common financial concern for people over 50. 63% listed it as their biggest money worry – 10% less than in 2023, and 12% less than in 2022. But the percentage of people worrying about these costs rises to 67% for 50-59 year olds.

At 40%, the next biggest financial concern is the fear of unexpected sudden costs (-4% since 2023). And running out of money during retirement came in third at 34% (-3% in 2023, and the same as in 2022).

Biggest financial concerns

The data is as follows:

- The cost of living rising. 63% 2024. 73% 2023.

- Fear of unexpected sudden costs. 40% 2024. 44% 2023.

- Running out of money during retirement. 34% 2024. 37% 2023.

- Value of your pension. 26% 2024. 24% 2023.

- How my children/grandchildren manage financially. 23% 2024. 27% 2023.

- Paying for long-term care. 20% 2024. 21% 2023.

- Outstanding debts. 18% 2024. 19% 2023.

- Increasing loan and credit costs due to rising interest rates. 9% 2024. 11% 2023.

- Outstanding mortgage. 7% 2024 and 2023.

- Something else. 1% 2024. 2% 2023.

- None of these. 17% 2024. 12% 2023.

One positive is that the number of people with no financial worries at all has risen to 17% – up 5% since 2023, and 6% since 2022. This rises to 23% for retirees, and 27% for the happiest over 50s. In fact, people are reporting less concern about all worries, except for the value of their pension.

Women are more worried than men when it comes to money

A higher percentage of women than men report being worried about each concern, except for paying for long-term care, where 20% of both women and men say it worries them. For men, this is a drop of 7% since 2023, and a drop of 10% since 2022. For women, it’s a drop of 2% since 2023, and a drop of 9% since 2022.

Last year, more men than women were worried about the value of their pension (27% versus 22%). In 2024, slightly more women list this as a concern at 27%, versus 25% of men.

Despite this rise, the number of women concerned is still low, considering 33% of them report having no private or personal pension, meaning they’re relying on a state pension alone. In comparison, just 20% of men report having no personal or private pensions.

One notable difference is worrying about the rising cost of living (68% of women versus 58% of men – although both are 10% down since 2023). Fear of unexpected costs is another (45% versus 35%), as is how children or grandchildren are managing financially (26% versus 19%).

And once again, men are 50% more likely to have no financial worries (22% – up 7% since 2023 and 2022) compared to women (11% – up 1% since 2023, and up 4% since 2022).

Like last year, retirees are less worried than non-retirees about things like the cost of living and unexpected costs. But they’re more concerned than non-retirees about issues that will affect their loved ones, like how their children and grandchildren are managing financially (25% versus 21%), and paying for long-term care (26% versus 16%).

Regional worries

Certain differences can be seen between the worries of different regions across the UK.

At 74% (+2% since 2023), Northern Ireland is the region most concerned about the rising cost of living. In fact, this region is where fewest are free from financial worries (11% – down 3% since 2023).

London is the least worried about the rising cost of living at 56% (-17% since 2023). But the North East is the region most likely to be free from any financial concerns at all (24% – up 8%).

Despite this, 30% (+3%) of those in the North East are worried about how their children and grandchildren are coping, compared to the average of 20%.

And Scotland are most worried about running out of money during retirement – with 39% naming this as one of their biggest financial concerns, compared to the national average of 34%.

This article forms part of our Life Well Spent report, which looks at the relationship between happiness and big purchases in later life. You can read the other sections of the report below or download the full report (PDF).