Debt

Part of the Life Well Spent Report 2025

It’s no surprise that debt can affect our happiness. But what debts are we worried about the most?

Almost half of us have outstanding debts

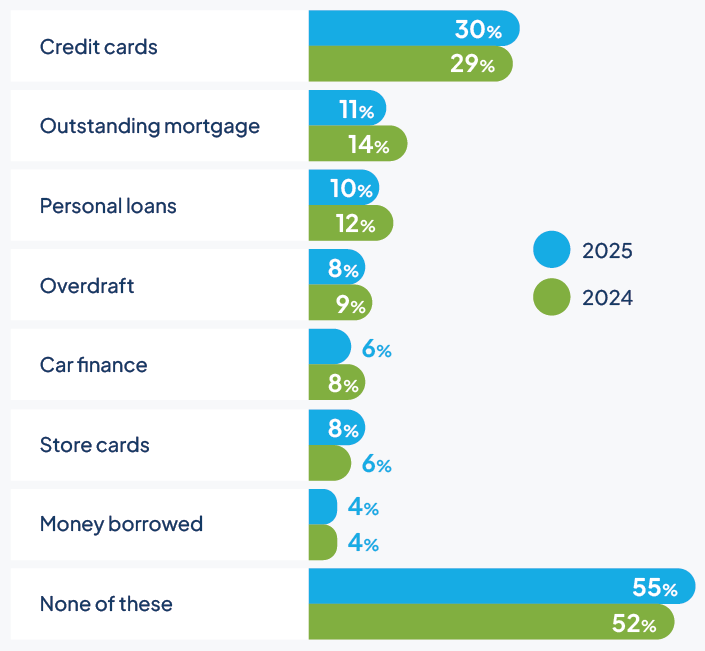

45% of people over 50 have outstanding debts – 3% down since 2024, and 1% up since our first report in 2022. Like previous years, the debts are mostly credit cards, mortgages and personal loans.

32% of retirees have outstanding debts (down 2% since 2024), compared to 54% of non-retirees (-2%).

And perhaps unsurprisingly, the happiest people are 8% less likely to be in debt than the overall average (-2% since 2024).

The most common debts

The average amount left to pay on the mortgage is almost £70,000

Those who are still paying off their mortgage have £67,538 left to pay on average – £1,253 less than in 2024, but £2,752 more than in 2022.

4% of retirees still have outstanding mortgages (down 1% since 2024), versus 16% of non-retired (-4%). They have an average outstanding amount of £48,643 – down £15,001 since last year – compared to those not yet retired, who have an average of £71,008 (-£2,912 since 2024) outstanding.

The debt that’s risen the most in 2025 is car finance, which has gone up by £1,393 to £11,375.

Average debt still left to pay

| 2025 | 2024 | |

| Outstanding mortgage | £67,538 | £68,791 |

| Car finance | £11,375 | £9,982 |

| Personal loans | £5,793 | £6,393 |

| Credit cards | £3,922 | £3,887 |

| Money borrowed | £3,870 | £4,178 |

| Overdraft | £1,575 | £1,377 |

| Store cards | £1,067 | £1,003 |

We’re spending almost £700 a month on repayments

Those with outstanding debt are spending a total of £696 per month on repayments on average – £28 less than in 2024. This represents 30% of total annual personal income (£27,382) or 23% of total annual household income (£36,113) being spent on debt repayment, and that’s before tax or other deductions are made.

At £842 per month, paying off the mortgage is the biggest repayment on average – down £45 since 2024. This is followed by car finance at £425 (+£26) per month, and credit cards at £403 (+£22 per month).

Retirees are repaying an average of £630 (+£28) per month across their debts, which is 24% of their average annual household income of £31,682.

Average monthly repayments

| 2025 | 2024 | |

| Outstanding mortgage | £842 | £887 |

| Car finance | £425 | £399 |

| Credit cards | £403 | £381 |

| Personal loans | £320 | £312 |

| Money borrowed | £150 | £143 |

| Overdraft | £107 | £132 |

| Store cards | £92 | £125 |

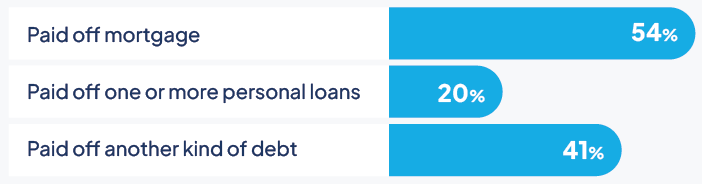

38% have paid off debts in the last five years

Almost 4 in 10 (38%) people have paid off some mid- to long-term debts in the last five years – up 1 % since 2024, and up 4% since 2022. But 16% (-1%) haven’t yet paid off any of their debts in full.

54% of people have paid off their mortgage in the past five years. This rises to an average of 61% for retirees, and 60% for the happiest people.

On average, the people who've paid off their mortgage in the last five years are 63, meaning they paid it off between ages 58 and 63. Those who are most worried about their outstanding mortgage, however, are slightly younger than this at 56.

Debts that have been paid off in the last five years

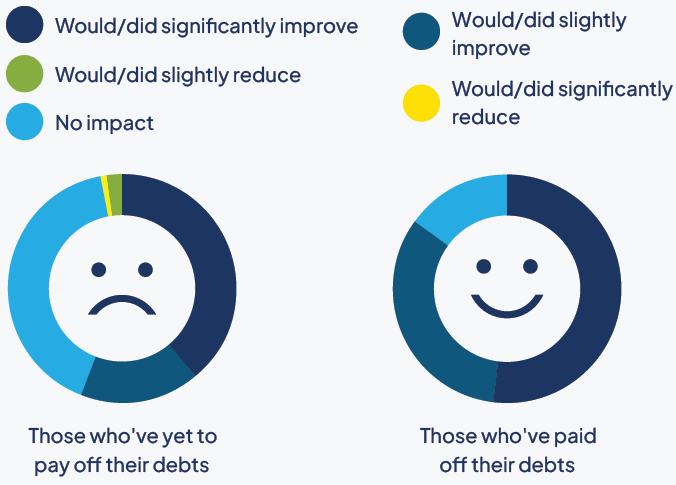

Paying off debt significantly improves happiness

Of those who haven’t yet paid off their debts, just 56% think it would make them happier to do so, 1% less than last year. 41% (+1%) think it would have no impact on their happiness. Just 3% think paying everything off would reduce their happiness (-1%).

But in reality, most people who’ve paid off their debts do feel happier as a result (85% – 2% up since 2024), including 52% (+1%) who say they feel significantly happier. And no one said paying off their debts reduced their happiness.

How paying off debts affects happiness

This article forms part of our Life Well Spent report, which looks at the relationship between happiness and big purchases in later life.