Equity release

Part of the Life Well Spent Report 2025

Equity release can make life-changing spends possible, such as dream holidays, renovations, gifts to family, or paying off debts. But many people don’t know the ins and outs of equity release today.

4 in 5 are aware of equity release

Equity release is a way to get tax-free cash from the value that’s tied up in your house. The most common type of equity release, a lifetime mortgage, is a loan that’s secured against your home. This is repaid when you die or move into permanent care.

Releasing equity could enable you to pay off debt, undertake home improvements, take that dream holiday or give your loved ones an early inheritance – plus much more.

80% of people are aware of equity release – 2% less than last year. Awareness rises to 89% among retirees, but this is also 2% less than in 2024.

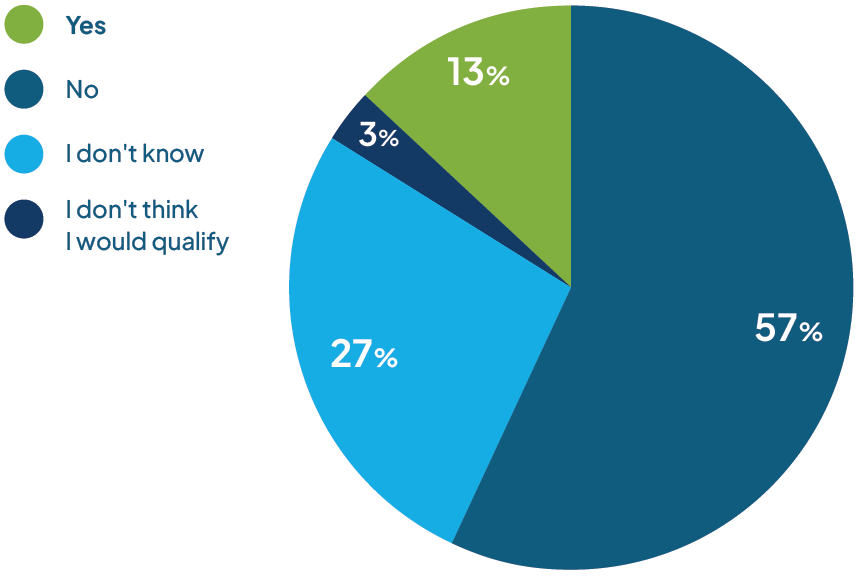

5% of eligible* homeowners have taken out equity release – down 1% since last year – representing under 3% of all people over 50. But of those who haven’t released equity, only 13% would consider it (-1%).

*Homeowners aged 55+ who are aware of equity release.

Only 6% know all the facts about equity release

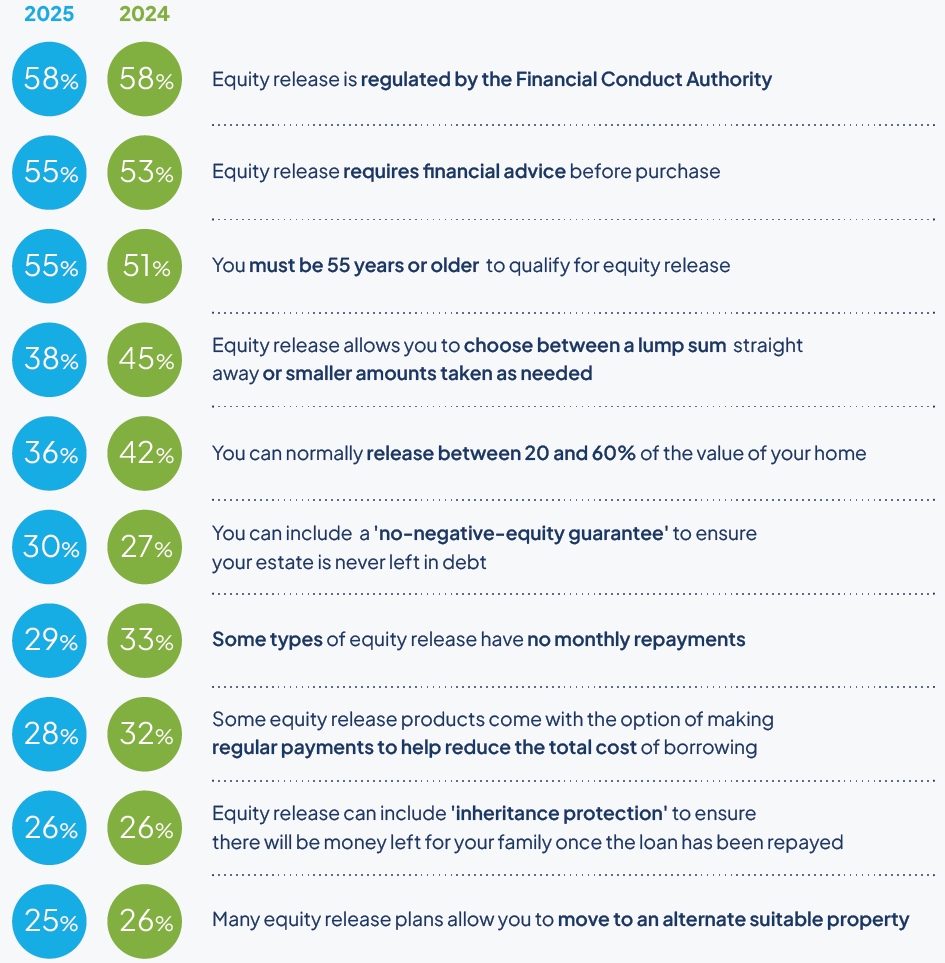

Despite most people being aware of equity release, many are unaware of the ins and outs. And, like last year, awareness of many features has gone down.

For example, 38% of people know that equity release allows you to choose between taking a cash lump sum straight away, or smaller amounts over time – down from 45% last year. Only 6% of homeowners who haven’t released equity know all the facts about equity release – the same as last year.

What equity release facts are people aware of?

The least known fact is that many equity release plans allow you to move to another suitable property. 25% of homeowners who are aware of equity release don’t know this.

70% don’t know that equity release products that follow Equity Release Council standards have a ‘no negative equity’ guarantee. This means homeowners releasing equity will never owe more than their home is worth, so their loved ones can’t be left in debt from equity release.

Those who wouldn’t consider equity release cite wanting to keep their home in the family, and not knowing enough about it.

It’s worth keeping in mind that all types of equity release products will reduce the value of an estate and could affect eligibility for means-tested benefits. Anybody considering equity release should discuss their options with an expert adviser.

Would you consider equity release?

People would like to release over £81,000 of equity

On average, people who would consider equity release would like to release £81,091. That’s £656 less than last year, and £7,052 more than in 2022.

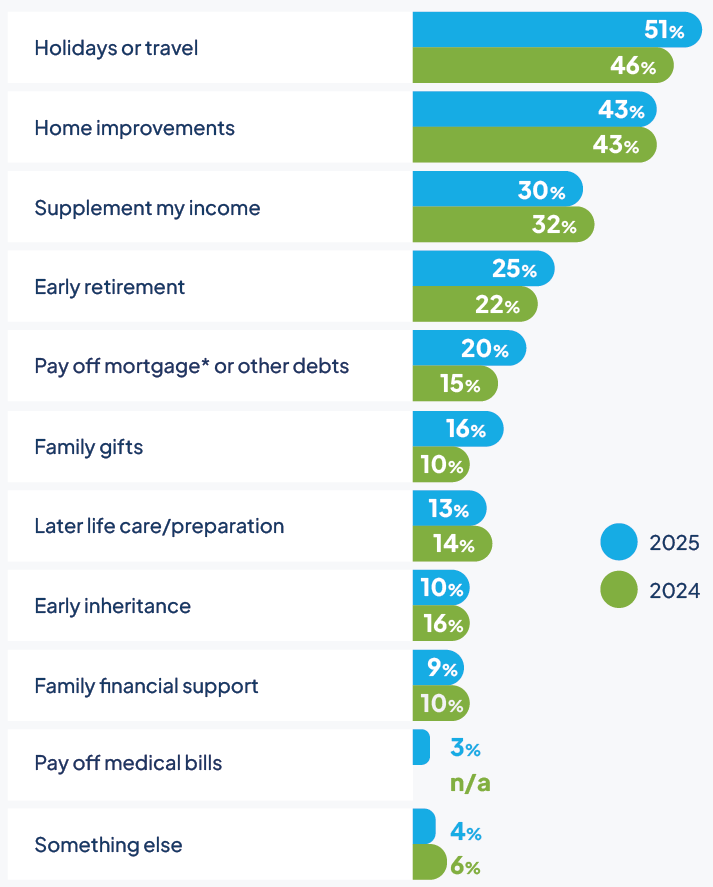

51% (up 5% since 2024) would spend at least some of the cash on holidays or travel. 43% would spend it on home improvements – the same as last year. 30% (-2%) would use it to supplement their income. And 25% (+3%) would take an early retirement.

The amount of equity release people would spend on holidays has dropped to £20,573 – down £2,455 since 2024 (but up by £3,328 since our first report in 2022).

The amount people would use to give their family financial support has dropped significantly from £31,563 in 2024, to £23,715 in 2025. And it’s dropped £15,093 since 2022.

What people would like to spend their equity release on

*Any equity released must first be used to pay off remaining mortgage.

The amount of equity release people would spend

The amount people say they’d spend on giving their loved ones an early inheritance has risen slightly, from £31,457 to £33,000.

Last year, the most people said they’d spend was on supplementing their income. But in 2025, early retirement is at the top spot, with respondents saying they’d spend £61,014 on this – up £2,453 since 2024, and up £2,201 since 2022.

The amount people would like to spend on supplementing their income is still high, at £52,023 – although this is down £9,785 since last year.

This is followed by later life care/preparation, at £47,932 – £5,975 more than last year.

When we look at average figures across the last three years, people would choose to spend £62,759 of their released equity on early retirement, £56,408 on supplementing their income, and £44,711 on later life care/preparation.

If people released equity, what’s the average amount they’d spend on each of these?

| 2025 | 2024 | % who would spend on this | 3-year average (2023-2025) | |

| Supplement my income | £52,023 | £61,808 | 30% | £56,408 |

| Early retirement | £61,014 | £58,561 | 25% | £62,759 |

| Later life care/preparation | £47,932 | £41,957 | 13% | £44,711 |

| Pay off mortgage* or other debts | £28,655 | £32,808 | 20% | £32,754 |

| Early inheritance | £33,000 | £31,457 | 10% | £40,846 |

| Family financial support | £23,715 | £31,563 | 9% | £32,232 |

| Home improvements | £21,713 | £25,568 | 43% | £25,304 |

| Family gifts | £16,183 | £15,906 | 16% | £23,641 |

| Holidays or travel | £20,573 | £23,028 | 51% | £27,996 |

| Pay off medical bills | £6,848 | n/a | 3% | £6,667 |

*Any equity released must first be used to pay off any remaining mortgage

People release just under £70,000 of equity on average

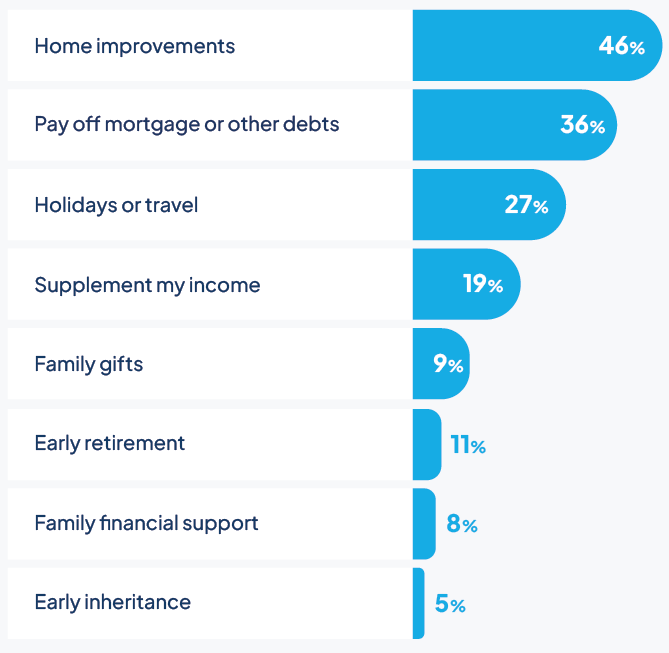

Of those who take out equity release (3% of all people over 50), the priorities and amounts spent tend to be quite different from those who are considering it. £62,057 is the average amount of equity actually released.

Home improvements are the most popular way to spend equity release cash, with 46% using the money for this purpose.

Second is paying off debts (including the mortgage, which is a requirement of all equity release schemes) at 35%. Third is supplementing income, at 19%. And fourth is holidays and travel, at 26%.

What people are spending their equity release on

People spend most on paying off their mortgage and other debts

When we asked how much of their equity release cash was spent on each category, paying off the mortgage and other debts comes out on top, with an average spend of £28,411 £767 more than last year.

At £18,332, supplementing income is the second biggest average spend. This is up significantly from last year, when it was just £12,706. Family financial support is third at £17,540, which is just £328 more than last year. But on average, people are spending less of their equity release cash on early retirement, early inheritance and family gifts compared to last year.

What’s the average amount of equity release spent on each of these?

| Average spend (2023-2025)* | Average spend (2022-2024* | |

| Pay off mortgage or other debts | £28,411 | £27,644 |

| Supplement my income | £18,332 | £12,706 |

| Family financial support | £17,540 | £17,212 |

| Home improvements | £12,361 | £11,188 |

| Early retirement | £7,891 | £10,929 |

| Later life care/preparation | £7,886 | £6,700 |

| Holidays or travel | £7,569 | £6,878 |

| Early inheritance | £7,333 | £9,836 |

| Family gifts | £7,331 | £8,270 |

| Pay off medical bills | n/a | n/a |

*Due to low base size, these figures are a three-year combined average i.e. the 2025 figure combines data from our 2025, 2024 and 2023 research.

3 in 4 say equity release made them happier

At 76% (+4% since 2024), over 3 in 4 people who released equity say it’s made them happier, with 4 in 10 (43%) saying it’s made them significantly happier. 19% (-3% since 2024) say it’s had no impact on their happiness.

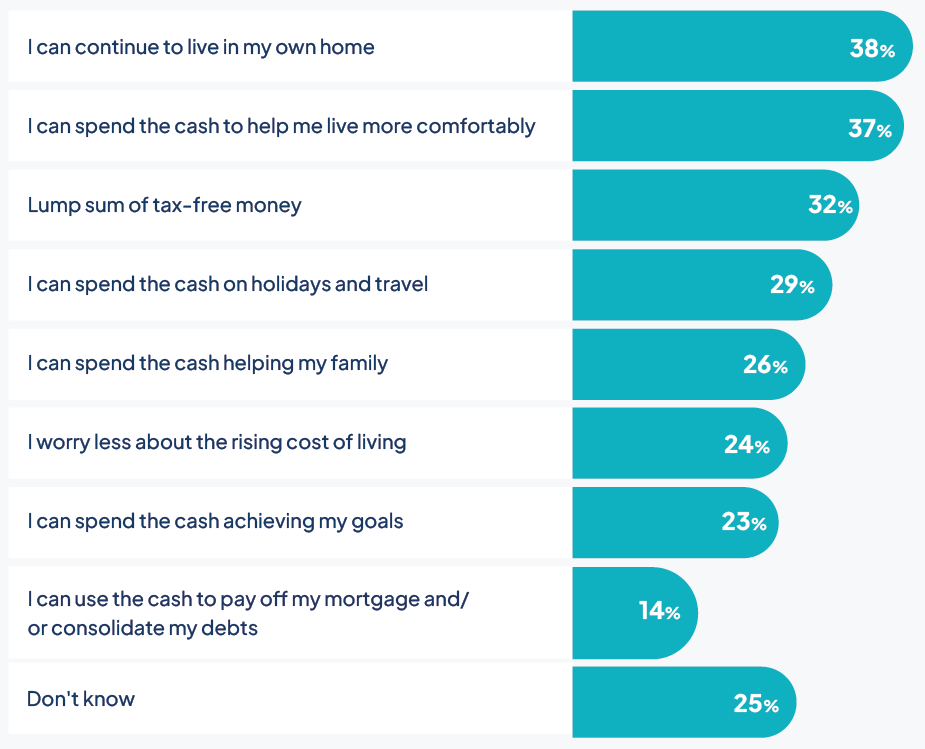

Homeowners see the three main benefits of equity release as being able to continue living in your own home (38% - up 1% since 2024), being able to live more comfortably (37% - down 1%), and receiving a lump sum of tax-free money (32% - down 4%). So, if you’d like to know more, visit our equity release hub.

The main benefits of equity release

Use our 60 second equity release calculator

Release tax-free cash from your home

This article forms part of our Life Well Spent report, which looks at the relationship between happiness and big purchases in later life.