The home

Part of the Life Well Spent Report 2025

Our house is our haven – but what makes the ‘perfect’ home? And can we afford to make home improvements while the cost of living is still so high?

The average homeowner over 50 has made over £65,000 in property equity

It won’t come as a shock to many that most house prices in the UK are still rising.

In fact, on average this year’s respondents say the value of their home has gone up 126% – from £151,074 to £342,163. That’s over a period of 22 years, which is the average length of time they’ve lived in their current home. Even when adjusted for inflation, that’s still an average profit of over £65,000 that homeowners over 50 have built in home equity.

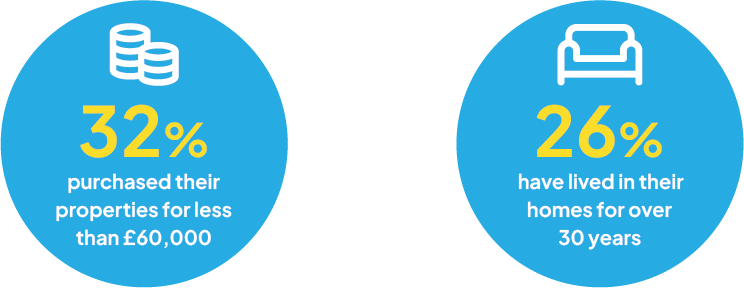

Over a quarter (26%) of respondents have lived in their homes for over 30 years. And almost a third (32%) purchased their properties for less than £60,000.

Our gardens are the most-loved part of our homes

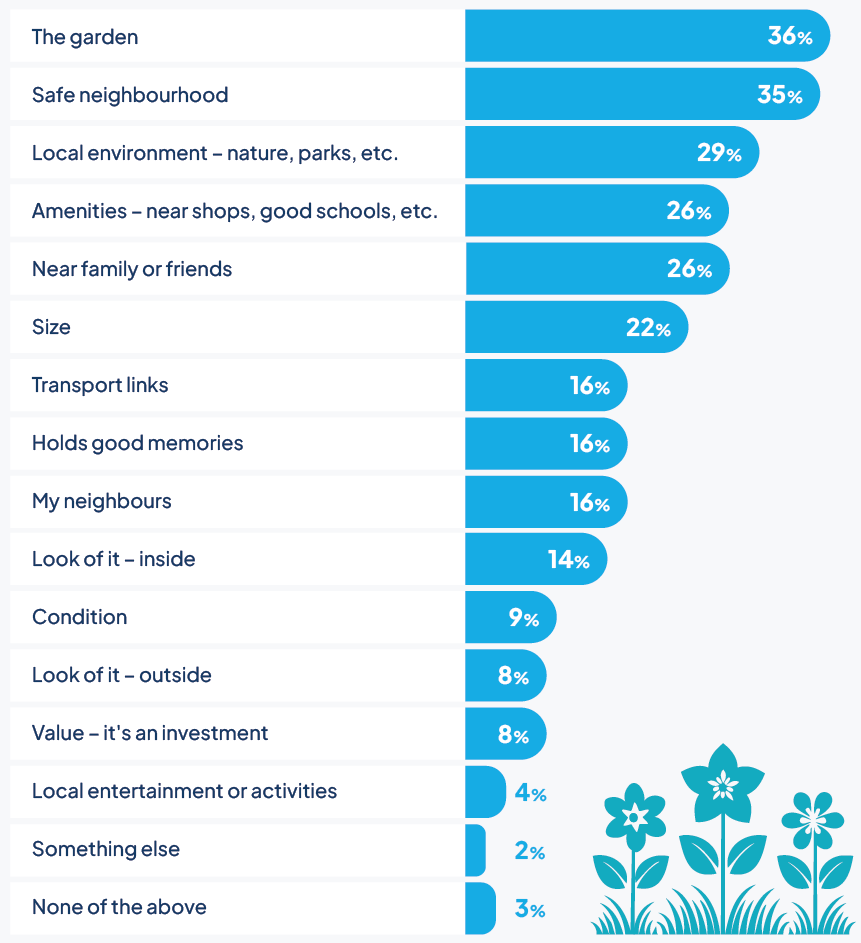

The monetary value of their property isn’t what matters most to people. Instead, 36% say their garden is one of the most loved parts of their home. 35% say it’s the safe neighbourhood, and 29% the local nature and parks. Amenities such as shops and schools, plus being near family and friends, tie in fourth and fifth place at 26%.

Only 8% of people say the value of their house is their favourite thing about it.

What we love most about our homes

1 in 4 say they don't want to move house but might have to

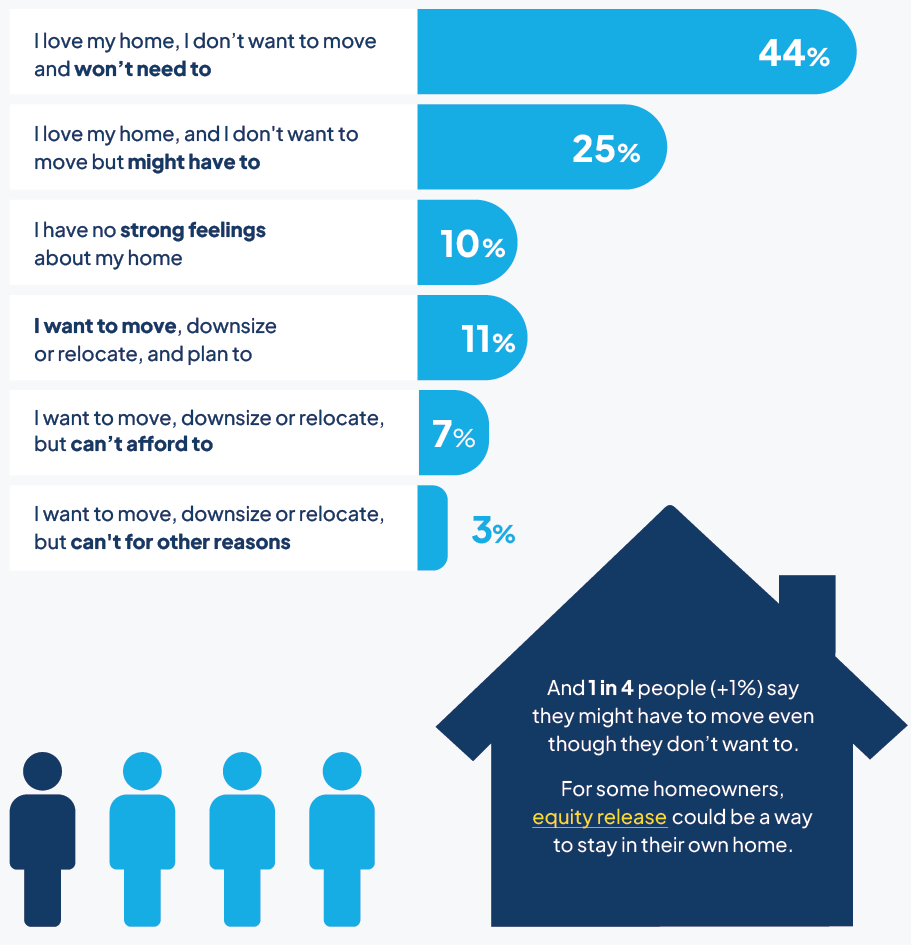

69% (up 1% since 2024) of people say they love their home, with 44% (+2%) saying they don’t want to – or need to – move house. This rises to 59% (+1%) for the happiest people.

11% are planning to relocate – the same as last year. While 7% (-3%) want to move, downsize or relocate, but can’t afford to. This rises to 15% (-6%) for the unhappiest people. And 3% of people want to move, but can’t due to non-financial reasons.

How we feel about our homes

Three quarters of people spend on home improvements

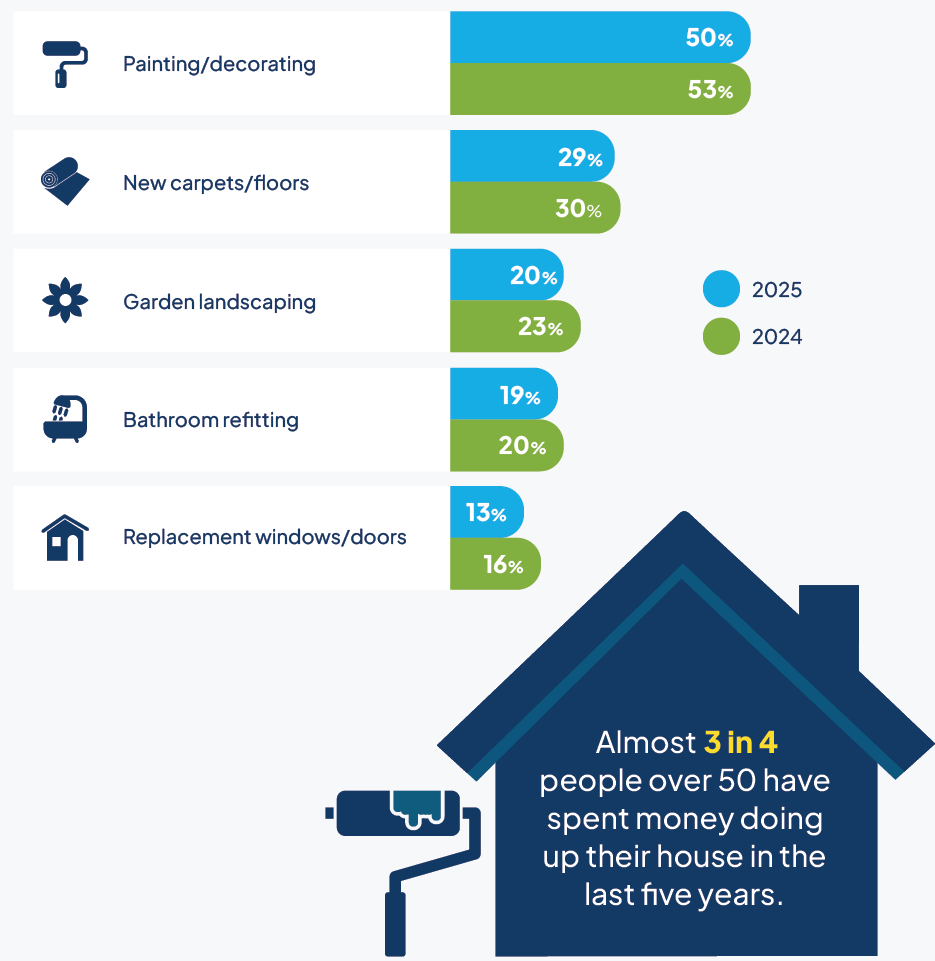

Almost 3 in 4 (73% – the same as in 2024) people have spent money doing up their house in the last five years.

Once again, painting and decorating is the most popular home improvement, with 50% (-3%) of people picking up a paintbrush. This is followed by new carpets and floors at 29% (-1%) and garden landscaping at 20% (-3%) – although a new bathroom closely follows at 19% (-1%).

A new kitchen, which came fifth in our first report in 2022, doesn’t make an appearance in the top five this year. Instead, new windows and doors come in fifth place at 13% (-3%).

The top five home improvements

Home improvements make us happier

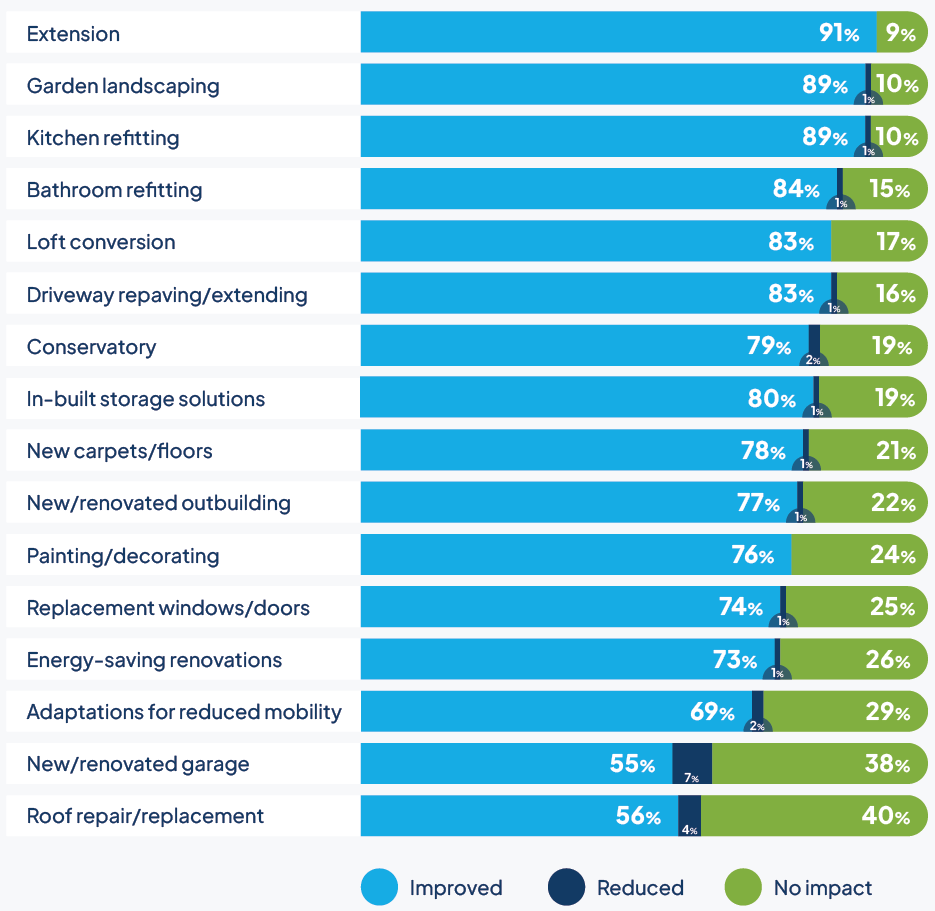

Just like in previous years, spending money on home improvements makes people happier. Overall, 84% of people who spent on home renovations say they felt happier as a result.

9 in 10 people said an extension, garden landscaping and a new kitchen made them happier – almost identical to 2024. While last year’s top renovation for happiness – a loft conversion – is now in fifth place.

But a more affordable way to boost happiness is painting or decorating, with over three quarters (76%) of people saying they are happier as a result – almost identical to previous years.

How home improvements make us happier

Half choose painting and decorating to spruce up their home

The priciest home renovations are still extensions. But the average amount spent on an extension has gone down to £22,325 – £4,092 less than in 2024 (and £9,782 less than in 2022).

Only 2% of people have extended their home in the last five years (-1% since 2024). Whereas 50% (-3%) have spent money on painting and decorating, which costs just £565 by comparison ( just £2 more than in 2024).

What we spend on home renovations

| Average spend | 2025 | % of people spending 2025 | 2024 |

| Extension | £22,325 | 2% | £26,417 |

| Conservatory | £9,196 | 3% | £7,592 |

| Loft conversion | £8,741 | 2% | £8,806 |

| Kitchen refitting | £8,670 | 13% | £7,961 |

| Replacement windows/doors | £4,778 | 13% | £4,384 |

| Bathroom refitting | £4,759 | 19% | £4,225 |

| Roof repair/replacement | £4,323 | 12% | £3,916 |

| Energy-saving renovations | £3,478 | 5% | £3,964 |

| Driveway repaving/extending | £3,270 | 6% | £2,709 |

| New/renovated garage | £1,985 | 2% | £2,318 |

| Garden landscaping | £1,902 | 20% | £2,191 |

| New/renovated outbuilding | £1,458 | 7% | £1,323 |

| In-built storage solutions | £1,411 | 4% | £1,315 |

| Adaptations for reduced mobility | £1,254 | 2% | £1,708 |

| New carpets/floors | £1,252 | 29% | £1,220 |

| Painting/decorating | £565 | 50% | £563 |

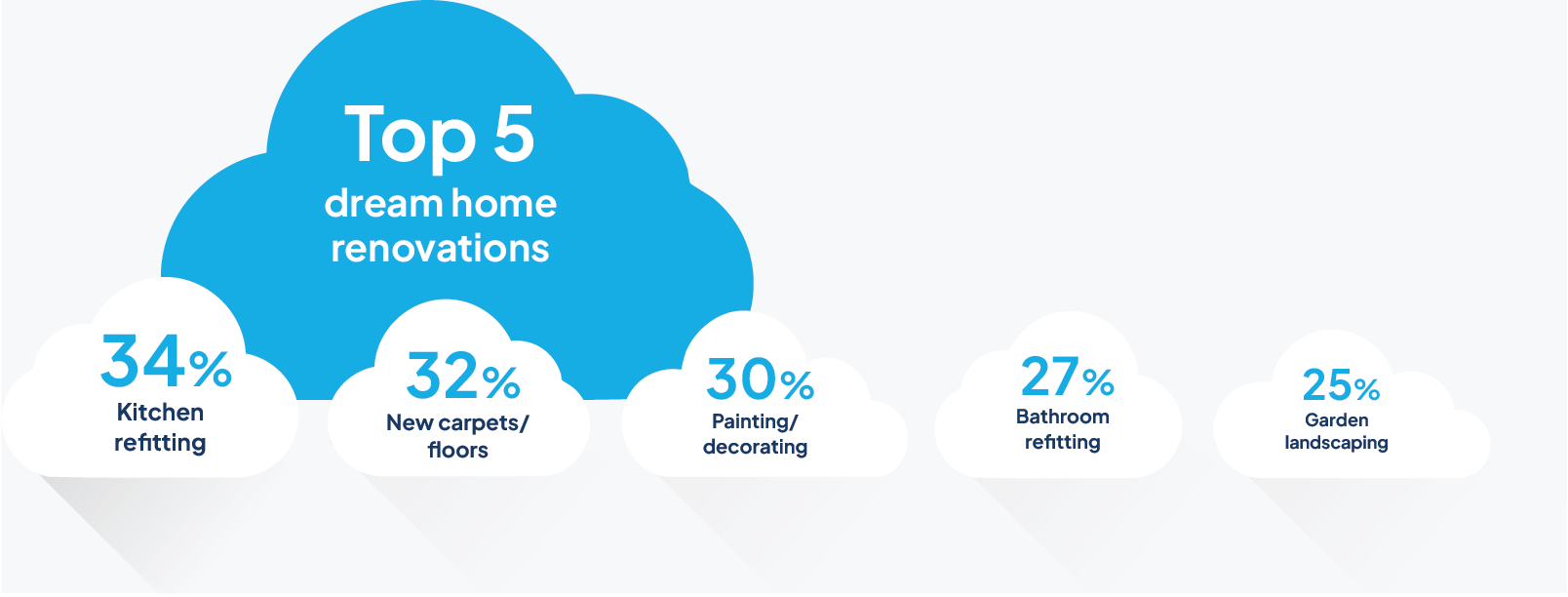

Most would like a new kitchen

If money was no object, people would still most like to redo their kitchen. 34% name it as their dream renovation (-1% since 2024).

Also like last year, new carpets or floors are next on the list at 32% (-2%). Third is painting and decorating at 30% (-1%). And a new bathroom follows at 27% (-3%), then garden landscaping at 25% (-1%).

But most don't think they'll be able to afford dream home renovations

Most people say they expect their dream home renovations to cost £24,493 on average – £4,172 less than in 2024, and £5,277 less than in 2022.

But 59% say they may not ever be able to afford their dream home improvement (-3% since 2024). In fact, only 17% are confident they’ll be able to carry out their dream renovations at some point – the same as the last two years, but 1% lower than in 2022.

Our dream home renovations are expected to cost £24,493

Out of all the age brackets, the over 70s have the most confidence that they can afford their dream renovations (19% – down 1% since 2024). But the happiest people are the most confident overall, with 26% (-1%) saying they can afford it – compared to the average of 17%.

For some homeowners, equity release could be one way to make dream home renovations possible.

This article forms part of our Life Well Spent report, which looks at the relationship between happiness and big purchases in later life.