How spending can affect our happiness: the latest findings

Part of the Life Well Spent Report 2025

We’ve all heard the saying ‘money can’t buy you happiness’. Most of us also know that having enough money to live comfortably can make life that little bit easier.

But are there certain spends that make us happier if we prioritise them? And what would we most like to splash out on if we came into some cash?

To help answer these questions and explore the connection between happiness and spending, look no further than the Life Well Spent report.

Every year, SunLife asks more than 2,000 people over 50 to share their attitudes to money and what big purchases they’ve made. The report also looks at the purchases they would like to make if money was no object. It delves into:

- Happiness

- Retirement

- Daily spending and financial concerns

- The home

- Holidays

- Cash gifts

- Debts

- Equity release

“The Life Well Spent report is an exploration into the lives, concerns and dreams of people over 50,” says Mark Screeton, SunLife’s CEO. “Read on to find out what’s on the nation’s mind – and what could be considered essential for living a happier, more fulfilled life.”

Family and friends matter most

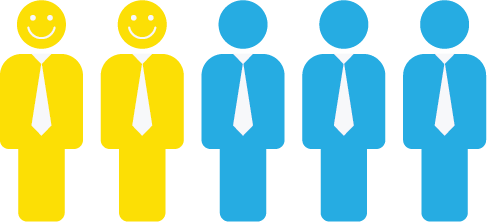

Good news – happiness rises with age! Over half of retirees score 8 or higher for overall life satisfaction, compared to just a third of those who are still working.

“Happiness does vary from region to region across the UK though,” says Victoria Heath, SunLife CMO. “North East England comes in top, while the West Midlands is at the bottom of the list.

“But it’s great to see that, overall, the number of people who rate their happiness as really high is going up, albeit slowly. It’s risen from 38% in 2022, to 41% in 2025.”

So what makes us truly happy? Half of us say family and friends are the biggest contributor – rising to 58% for the happiest people.

Retirement makes us happier

Almost two thirds of those who’ve retired say they are happier in the long term. And only 1 in 10 say they feel less happy since retiring.

But retired people are twice as likely to list their family’s financial wellbeing as their main worry, compared to non-retirees.

The number of us worried about the rising cost of living has dropped

The rising cost of living is worrying far fewer of us in 2025, with over half saying it’s our biggest money worry, compared to three quarters of us in 2022. In fact, financial concerns have dropped across all categories this year.

“This is great news, of course,” says Screeton. “But, while the number of people reporting each individual financial concern has gone down, the number of people who have at least one financial concern has gone up. So, overall, more of us are worrying about money.”

Home improvements don't need to be big to boost your happiness

Extensions, garden landscaping, and new kitchens are the cheeriest home renovations. 9 in 10 of us say these improvements made us happier.

“Thankfully, we don’t have to pay for an extension or fancy new kitchen to boost our happiness,” says Heath. “On average, painting and decorating costs just £565, and over three quarters of people say doing this simple DIY made them happier.”

Travel confidence is low for some

Holidays are important to all of us, with 1 in 10 saying travel is what makes us happiest. In fact, the happiest people go on more holidays, both abroad and in the UK.

At an average of £6,098, we have more modest expectations about what our dream holiday will cost in 2025. (The average dream holiday was £1,003 more expensive in 2024.) And our top dream holiday destination is the USA.

But despite holidays being a big contributor to our overall happiness, 1 in 5 have decided not to travel because of a health condition. And of those who get travel insurance, 17% say they wouldn't feel confident making a claim.

“Health concerns or uncertainty about insurance can turn a dream trip into a missed opportunity,” says Screeton. “But with the right support, people can turn their dream holidays into reality and enjoy more of the experiences that contribute to a life well spent.”

Giving an early inheritance makes us happier

The average cash gift given to family is £12,323 and gifting cash for any reason boosts our happiness!

“These contributions are shown to improve the happiness of those gifting the funds,” says Screeton, “making this a positive experience for both generations.”

It's no surprise that gifting family money makes us happier, when family is clearly so important to so many of us. This applies across the board – whether the money is to help out new parents, or is simply for an extra-special birthday gift.

"And for many families, the ‘Bank of Mum and Dad’ isn't just helping children take their first steps onto the property ladder – it's helping them secure a better financial future,” continues Screeton.

This explains why almost half of us would like to leave an inheritance behind, while only a fifth of us would prefer to spend our money enjoying retirement.

Average debt repayments are almost £700 a month

Almost half of us have outstanding debts. This rises to an average of 54% for those of us who are yet to retire, while it drops to less than a third of retirees.

On average, our debt repayments come to £700 a month – almost a third of total annual personal income.

And car finance costs have seen the biggest hike in price, with an overall rise of £1,393 in the last year alone.

People would like to release over £80,000 of equity

Over two fifths of us don't realise that the equity release industry is regulated by the Financial Conduct Authority. But the good news is, three quarters of those who've released equity say it's made them happier.

On average, eligible people who'd consider equity release in 2025 would choose to release just over £81,000. They'd like to spend at least some of the money on holidays and travel, home renovations, supplementing their income, and an early retirement.

But when people actually release equity, they release an average of £69,982 – £11,109 less than those in the consideration stage would like to access.

The most popular ways to spend the money are paying off the mortgage (which is a prerequisite) and other debts, home improvements, supplementing income, and holidays and travel.

“Many of us might not realise that we're property rich and cash poor,” says Screeton. “Releasing equity isn't for everyone, but for some it can be a way to make things happen – whether that's a new car, the trip of a lifetime, or helping your kids get onto the property ladder.

“And the bonus is, over three quarters of people who've released equity say it's made them happier, too.”

Find out more

You can read the full 2025 Life Well Spent report here.

The Life Well Spent report is now in its fourth year. For information on any of SunLife’s current reports or past editions, email pressoffice@sunlife.co.uk.

Use our 60 second equity release calculator

Release tax-free cash from your home

This article forms part of our Life Well Spent report, which looks at the relationship between happiness and big purchases in later life.